What Bond Markets Are Telling Investors About Federal Reserve Policy

Jerome Powell's recent remarks at the Federal Reserve's Jackson Hole symposium have garnered significant media attention and reinforced expectations for a September interest rate reduction.

The Fed Chair highlighted the need to balance inflation concerns, including uncertainties around tariffs, with employment market support. With markets trading near record levels, investor sentiment appears aligned with the Fed's policy direction and reflects economic optimism. For long-term investors, understanding the implications of potential rate reductions within the current economic context becomes essential.

The importance of Federal Reserve credibility in market dynamics

Market trust in Federal Reserve policy represents a critical yet underappreciated element of monetary transmission mechanisms. Bond markets function as an important validation system for central bank actions.

Although the Fed controls short-term interest rates, market forces determine longer-term borrowing costs that influence mortgage rates and corporate financing. Effective monetary policy relies on investor confidence in the Fed's capacity to meet objectives through both rate adjustments and forward guidance.

The 1970s exemplify how diminished Fed credibility can push rates higher despite policy intentions. When the central bank's anti-inflation commitment wavered, allowing price pressures to escalate, bond investors effectively tightened monetary conditions by demanding elevated yields as inflation compensation. Conversely, the period following 2008 demonstrated how Fed credibility helped anchor long-term price expectations. Even when the Fed's initial response to post-pandemic inflation appeared delayed, decisive rate increases and clear communication helped restore expectation stability.

Corporate bond yields provide valuable insight into both Fed and economic confidence levels. These yields reflect the premium investors demand for lending to businesses based on perceived risk. Yields typically decline when economic conditions are robust and corporate earnings are expanding, while widening during periods of financial or economic uncertainty. Corporate credit spreads similarly indicate the additional yield investors require above risk-free government securities.

Current market conditions suggest sustained confidence levels. Corporate bond markets provide among the clearest confidence indicators, with credit yields and spreads reaching multi-year lows, as illustrated in the accompanying chart. High-yield spread compression similarly reflects investor comfort with corporate credit exposure. This aligns with equity indices achieving fresh record highs driven by investor optimism.

Federal Reserve policy signals point toward easing

Powell's Jackson Hole address recognized the complex balance required between inflation control and employment support. While acknowledging that "risks to inflation are tilted to the upside" due to tariff effects, he also highlighted "significant risks to employment to the downside." This dual emphasis reflects the Fed's dual mandate of price stability and full employment.

Current economic indicators highlight this policy challenge. The Personal Consumption Expenditures Price Index, the Fed's preferred inflation gauge, has increased 2.6% annually, while core PCE rose 2.8%. These readings exceed the Fed's 2% objective, and combined with Consumer Price Index and Producer Price Index data, suggest businesses are starting to transfer higher costs to consumers.

Employment conditions, however, have displayed unexpected weakness. July's employment report showed just 73,000 new jobs created, significantly below historical averages and economist projections. Previous month revisions indicated greater labor market cooling than initially recognized. While unemployment has held steady between 4.0% and 4.2%, this stability partially reflects reduced workforce participation and immigration policy changes affecting labor availability.

The Fed must assess whether tariff-driven price increases represent temporary adjustments or signal broader inflationary momentum. Currently, the central bank appears positioned for measured rate reductions.

Interest rate reductions generate bond market opportunities

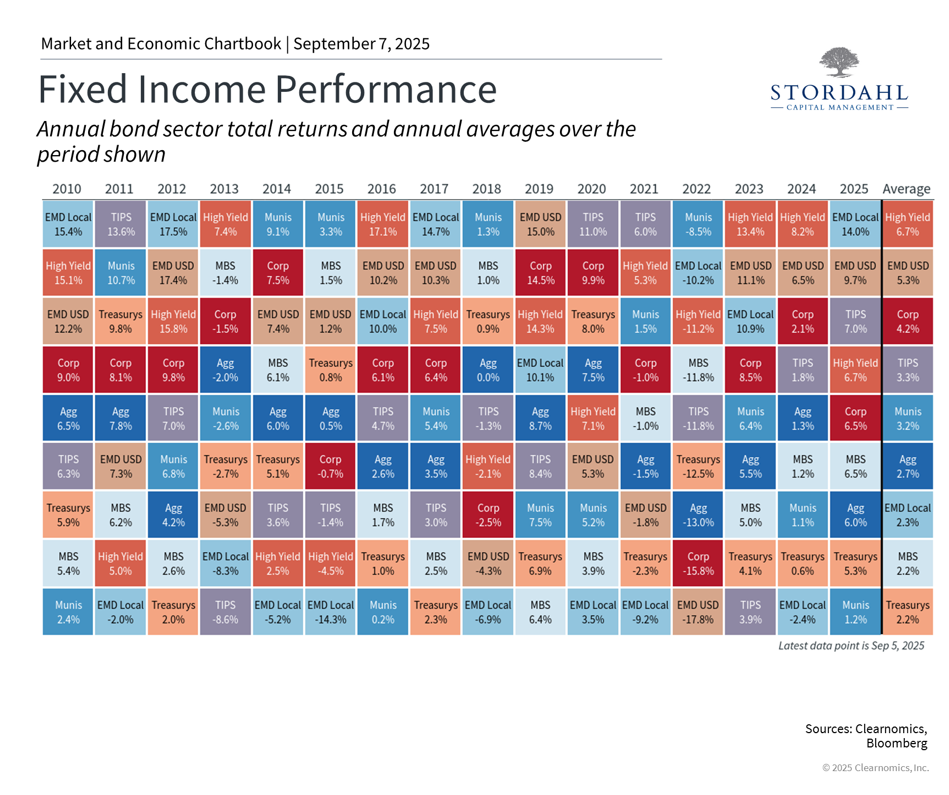

Expected Fed rate cuts carry significant implications for all market participants. Historically, declining policy rates support bond valuations, as existing higher-yielding securities become more attractive. Additionally, rate changes and market volatility have benefited diversified fixed income allocations. These dynamics have contributed to the U.S. Aggregate Bond Index generating 4.8% total returns year-to-date.

Regardless of long-term rate direction, current bond yields remain compelling. Treasury securities currently average 4.0% yields, investment grade corporate bonds offer 4.9%, and high yield debt provides 6.9%. These income-generating yields substantially exceed post-2008 averages, supporting portfolio income objectives.

For equity investors, reduced rates typically lower corporate borrowing expenses, potentially enhancing growth prospects. This environment can support higher valuations as future cash flows gain present value when discounted at lower rates. Recent market highs suggest investors are already positioning for this favorable backdrop.

However, with compressed credit spreads and elevated market valuations, maintaining discipline remains crucial. When spreads narrow significantly, corporate bonds may offer limited upside potential and face headwinds if conditions worsen. Similarly, high valuations can signal reduced long-term return expectations.

Rather than avoiding asset classes entirely or attempting market timing, this environment emphasizes proper asset allocation to manage these considerations. Well-diversified portfolios can capitalize on stable economic conditions and anticipated rate cuts while maintaining downside protection against unforeseen developments.

The bottom line? Strong market confidence in Fed policy direction, supported by solid corporate fundamentals, presents opportunities for patient investors. Maintaining appropriate portfolio diversification remains the optimal approach for managing long-term risks and returns.

Questions? We offer a complimentary 15-minute call to discuss your concerns and explore how we can assist you.

Stordahl Capital Management, Inc is a Registered Investment Adviser. This commentary is solely for informational purposes and reflects the personal opinions, viewpoints, and analyses of Stordahl Capital Management, Inc. and should not be regarded as a description of advisory services or performance returns of any SCM Clients. The views reflected in the commentary are subject to change at any time without notice. Nothing in this piece constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Advisory services are only offered to clients or prospective clients where Stordahl Capital Management and its representatives are properly licensed or exempt from licensure. No advice may be rendered by Stordahl Capital Management unless a client service agreement is in place. Stordahl Capital Management, Inc provides links for your convenience to websites produced by other providers or industry-related material. Accessing websites through links directs you away from our website. Stordahl Capital Management is not responsible for errors or omissions in the material on third-party websites and does not necessarily approve of or endorse the information provided. Users who gain access to third-party websites may be subject to the copyright and other restrictions on use imposed by those providers and assume responsibility and risk from the use of those websites. Please note that trading instructions through email, fax, or voicemail will not be taken. Your identity and timely retrieval of instructions cannot be guaranteed. Stordahl Capital Management, Inc. manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.

Copyright (c) 2024 Clearnomics, Inc. All rights reserved. The information contained herein has been obtained from sources believed to be reliable, but is not necessarily complete and its accuracy cannot be guaranteed. No representation or warranty, express or implied, is made as to the fairness, accuracy, completeness, or correctness of the information and opinions contained herein. The views and the other information provided are subject to change without notice. All reports posted on or via www.clearnomics.com or any affiliated websites, applications, or services are issued without regard to the specific investment objectives, financial situation, or particular needs of any specific recipient and are not to be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. Past performance is not necessarily a guide to future results. Company fundamentals and earnings may be mentioned occasionally, but should not be construed as a recommendation to buy, sell, or hold the company's stock. Predictions, forecasts, and estimates for any and all markets should not be construed as recommendations to buy, sell, or hold any security--including mutual funds, futures contracts, and exchange traded funds, or any similar instruments. The text, images, and other materials contained or displayed in this report are proprietary to Clearnomics, Inc. and constitute valuable intellectual property. All unauthorized reproduction or other use of material from Clearnomics, Inc. shall be deemed willful infringement(s) of this copyright and other proprietary and intellectual property rights, including but not limited to, rights of privacy. Clearnomics, Inc. expressly reserves all rights in connection with its intellectual property, including without limitation the right to block the transfer of its products and services and/or to track usage thereof, through electronic tracking technology, and all other lawful means, now known or hereafter devised. Clearnomics, Inc. reserves the right, without further notice, to pursue to the fullest extent allowed by the law any and all criminal and civil remedies for the violation of its rights.