The Week in Review: September 8, 2025

No Hire, No Fire Economy

For starters, the title is a simplified five-word summary of the labor market. Recall that last week, we explored the low level of layoffs. This week, we shift the focus to hiring trends. But first, let’s take a closer look at the numbers from the latest jobs report.

The US BLS reported that nonfarm payrolls rose just 22,000 in August, below the forecast of 75,000, according to the Wall Street Journal. Revisions to the last two months were minor.

The unemployment rate ticked up from 4.2% in July to 4.3% in August, the highest since October 2021.

When it comes to job creation, most of what we see is occurring in health care. Since the beginning of the year, 456,000 net new jobs have been added in health care, which accounts for the lion’s share of private sector jobs.

There has been a net gain of 511,000 in private sector jobs, per US BLS data.

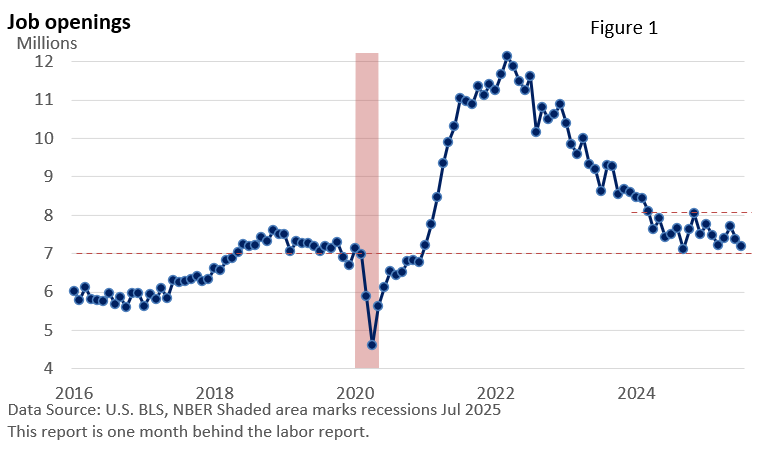

There are jobs that are available, as evidenced by Figure 1, though they have declined.

But hiring has slowed—Figure 2. Please note that total hires include all hires, not just net new jobs. It reflects gross (total) hiring activity, which is naturally much larger than net job growth (nonfarm payrolls).

What does last Friday’s jobs report mean for investors?

The data strengthens the case for a rate cut at the Federal Reserve’s upcoming two-day meeting on September 16–17. Signs of a cooling labor market are evident, and the Fed will likely feel compelled to act.

The key question now is how aggressive that action will be. Will the Fed opt for a modest 0.25 percentage-point cut, or will it take a bolder step with a 0.50 percentage-point reduction in the federal funds rate?

Yet, it’s not as though the economy appears to be teetering on the brink of recession.

The Atlanta Fed’s GDPNow model—a real-time estimate of economic growth—is projecting 3.0% annualized GDP growth for Q3 (September 4 is the latest projection).

While it’s still early in the quarter and the model currently reflects mostly July’s data, the current projection suggests that economic momentum hasn’t stalled. But the Fed’s focus is shifting away from still-elevated inflation and toward the risks that appear to be rising in the labor market.

Market Summary

TWO FOR THE ROAD

I’m convinced that everything that’s important in investing is counterintuitive, and everything that’s obvious is wrong.” — Howard Marks

“The first rule of compounding is to never interrupt it unnecessarily.” - Charlie Munger

Please do not hesitate to contact me with any questions or concerns.

I hope you have a great week!

Warmest Regards,

Bill Stordahl, CFP®

Managing Director

Stordahl Capital Management

Sources: ConstitutionCenter.org, ConstitutionFacts.com, Military.com, CNN

Stordahl Capital Management, Inc is a Registered Investment Adviser. This commentary is solely for informational purposes and reflects the personal opinions, viewpoints, and analyses of Stordahl Capital Management, Inc. and should not be regarded as a description of advisory services or performance returns of any SCM Clients. The views reflected in the commentary are subject to change at any time without notice. Nothing in this piece constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Advisory services are only offered to clients or prospective clients where Stordahl Capital Management and its representatives are properly licensed or exempt from licensure. No advice may be rendered by Stordahl Capital Management unless a client service agreement is in place. Stordahl Capital Management, Inc provides links for your convenience to websites produced by other providers or industry-related material. Accessing websites through links directs you away from our website. Stordahl Capital Management is not responsible for errors or omissions in the material on third-party websites and does not necessarily approve of or endorse the information provided. Users who gain access to third-party websites may be subject to the copyright and other restrictions on use imposed by those providers and assume responsibility and risk from the use of those websites. Please note that trading instructions through email, fax, or voicemail will not be taken. Your identity and timely retrieval of instructions cannot be guaranteed. Stordahl Capital Management, Inc. manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.

1. The Dow Jones Industrials Average is an unmanaged index of 30 major companies which cannot be invested into directly. Past performance does not guarantee future results.

2. The NASDAQ Composite is an unmanaged index of companies which cannot be invested into directly. Past performance does not guarantee future results.

3. The S&P 500 Index is an unmanaged index of 500 larger companies which cannot be invested into directly. Past performance does not guarantee future results.

4. The Global Dow is an unmanaged index composed of stocks of 150 top companies. It cannot be invested into directly. Past performance does not guarantee future results.

5. CME Group front-month contract; Prices can and do vary; past performance does not guarantee future results.

6. CME Group continuous contract; Prices can and do vary; past performance does not guarantee future results.