The Week in Review: February 17, 2026

Revisiting 2025 Employment

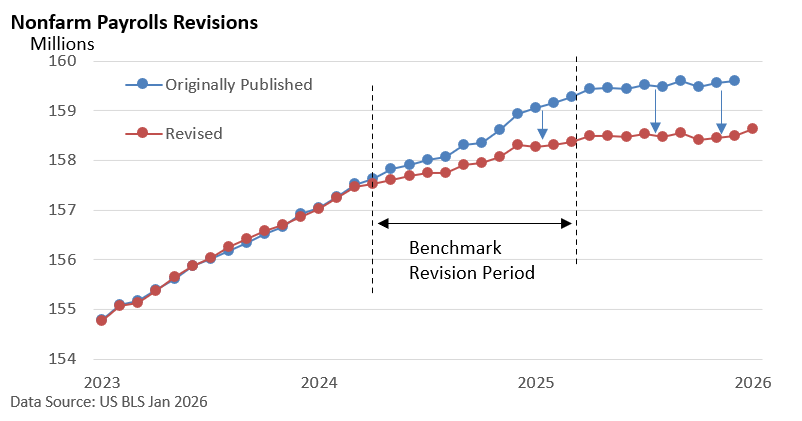

The US Bureau of Labor Statistics published its final benchmark revisions covering employment during the 12‑month period between April 2024 and March 2025. The revisions showed that payrolls were revised lower by 898,000 jobs compared with the originally reported figures. The 898,000 reflects the total number of jobs overstated once the BLS incorporated more complete Quarterly Census of Employment and Wages payroll-tax data. These counts are derived from state unemployment insurance tax records that nearly all employers are required to file.

In September, the preliminary benchmark estimate had suggested a larger reduction of 911,000 jobs, meaning the final revision was slightly smaller.

The September estimate did not include monthly breakdown estimates. Monthly revisions totaling 898,000 were incorporated in the January release.

Separately, the BLS also updates the methodology it uses to estimate monthly business openings and closures. These adjustments flow through to the employment data, impacting the reported job numbers for the remainder of 2025, April through December.

What does this look like graphically? The economy created fewer jobs than initially reported.

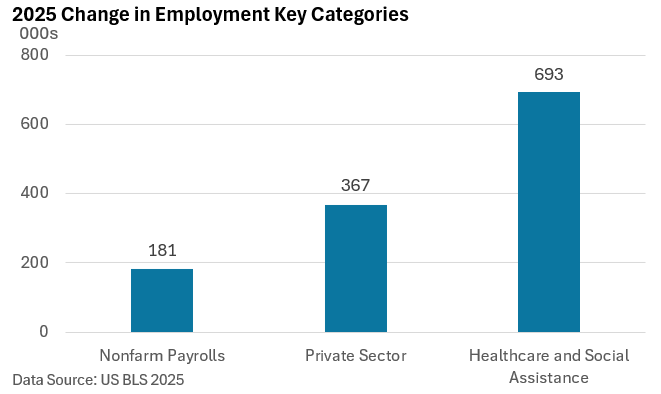

In summary, instead of 584,000 net new jobs in 2025, payrolls were revised to just 181,000.

Notably, the engine of job growth is the healthcare sector, which added 693,000 jobs last year. Outside of healthcare, private sector employment declined.

With all of this in mind, let’s briefly review January’s jobs data from the BLS.

Nonfarm payrolls rose by a better-than-expected 130,000, with jobs in the private sector rising by 172,000.

As we saw last year, healthcare continues to play an outsized role, with a 124,000 increase.

Additionally, the unemployment rate fell from 4.4% in December to 4.3% in January.

All in all, January’s data was a mix of good news and bad news. Payrolls increased, and the unemployment rate fell, but one industry fueled most of January’s job growth.

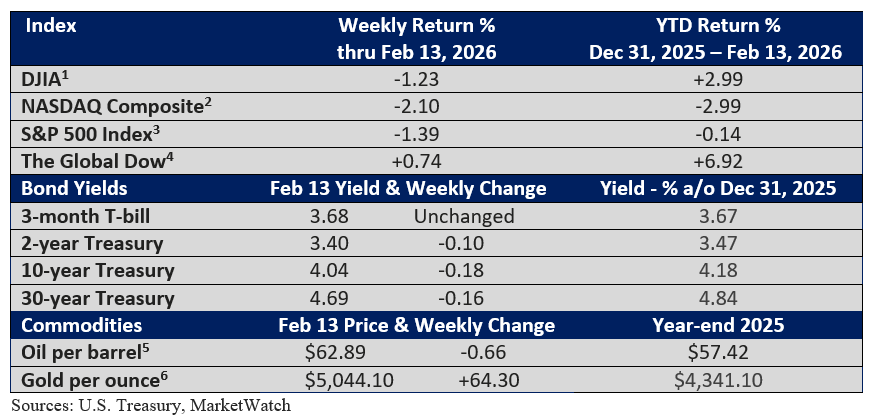

Elsewhere, the stock market was closed on February 16 in observance of Presidents' Day.

Originally established in 1879 to honor George Washington’s birthday and still officially called Washington's Birthday, it has since grown into a celebration recognizing all American presidents and their contributions to the nation.

Today, Presidents’ Day serves as a moment to reflect on the country’s history, leadership, and the ideals that have shaped the United States.

Market Summary

Two FOR THE ROAD

Gerald Ford was the first U.S. president to completely change his name - he was actually born Leslie Lynch King, Jr. His mother fled an abusive marriage just days after his birth, later remarrying, and Ford took his stepfather’s name at 22. Bill Clinton also changed his name at 15 (he was formerly William Jefferson Blythe), taking his stepfather’s surname but keeping his first name. - History Facts, February 20th 2025

George Washington never knew dinosaurs existed. He died in 1799, but the first dinosaur fossil wasn’t discovered until 1824. - Snopes, January 3, 2024

Please let me know if you have any questions or concerns that you would like to discuss.

I hope you have a wonderful week!

Warmest Regards,

Bill Stordahl, CFP®

Managing Director

Stordahl Capital Management

A Weekly Perspective on Planning and Markets

Each week, we share The Week in Review — a short collection of articles on

financial planning and wealth management, along with a brief overview for context.

One email per week. No promotions, no sales – just clarity.

Stordahl Capital Management, Inc is a Registered Investment Adviser. This commentary is solely for informational purposes and reflects the personal opinions, viewpoints, and analyses of Stordahl Capital Management, Inc. and should not be regarded as a description of advisory services or performance returns of any SCM Clients. The views reflected in the commentary are subject to change at any time without notice. Nothing in this piece constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Advisory services are only offered to clients or prospective clients where Stordahl Capital Management and its representatives are properly licensed or exempt from licensure. No advice may be rendered by Stordahl Capital Management unless a client service agreement is in place. Stordahl Capital Management, Inc provides links for your convenience to websites produced by other providers or industry-related material. Accessing websites through links directs you away from our website. Stordahl Capital Management is not responsible for errors or omissions in the material on third-party websites and does not necessarily approve of or endorse the information provided. Users who gain access to third-party websites may be subject to the copyright and other restrictions on use imposed by those providers and assume responsibility and risk from the use of those websites. Please note that trading instructions through email, fax, or voicemail will not be taken. Your identity and timely retrieval of instructions cannot be guaranteed. Stordahl Capital Management, Inc. manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.

1. The Dow Jones Industrials Average is an unmanaged index of 30 major companies which cannot be invested into directly. Past performance does not guarantee future results.

2. The NASDAQ Composite is an unmanaged index of companies which cannot be invested into directly. Past performance does not guarantee future results.

3. The S&P 500 Index is an unmanaged index of 500 larger companies which cannot be invested into directly. Past performance does not guarantee future results.

4. The Global Dow is an unmanaged index composed of stocks of 150 top companies. It cannot be invested into directly. Past performance does not guarantee future results.

5. CME Group front-month contract; Prices can and do vary; past performance does not guarantee future results.

6. CME Group continuous contract; Prices can and do vary; past performance does not guarantee future results.