Is AI Eating the World? A Portfolio Perspective

Fifteen years ago, venture capitalist Marc Andreessen famously wrote that "software is eating the world." What he meant was that any service that could be written and automated as software would be.

This has proved accurate as cloud computing, software-as-a-service, and digital platforms have reshaped both entire industries and how consumers buy goods and services. As investors, this has important implications and is a major source of recent market volatility.

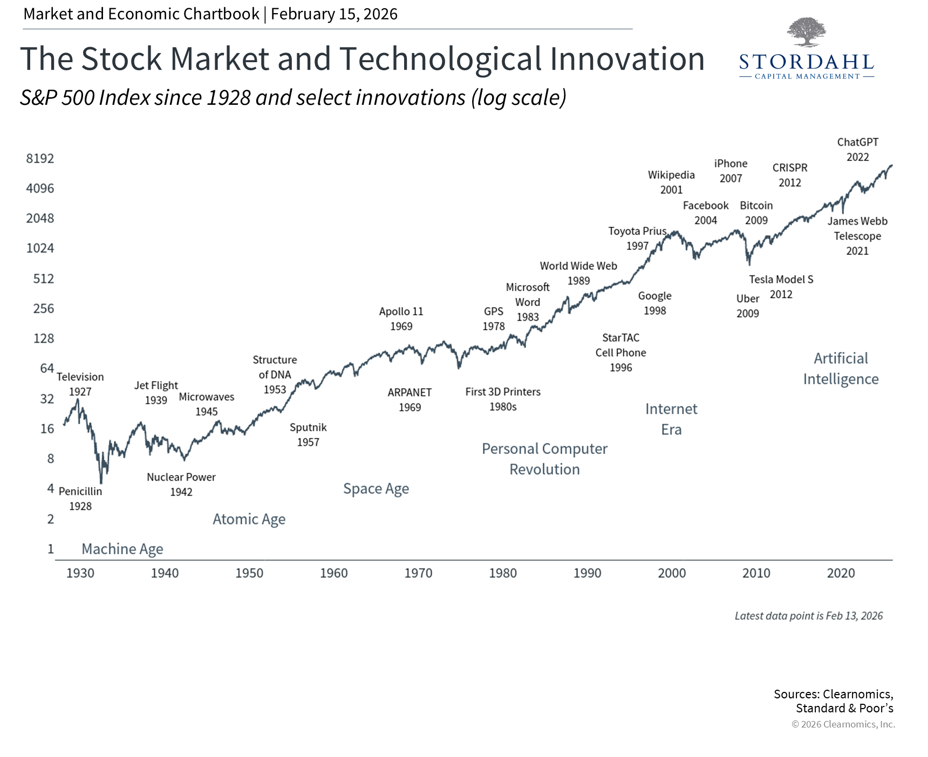

Today, AI represents the next phase of this transformation, and as with every major technological shift, markets are trying to assess what it means for specific sectors and the overall economy. For long-term investors, maintaining perspective on how these cycles have unfolded in the past can provide helpful clarity.

Innovation and disruption are two sides of the same coin, and the recent broad sell-off and quick bounce back in technology stocks show how difficult it can be to predict how these trends play out.

The release of new automation tools by Anthropic, a major AI company, demonstrated the ability to perform tasks previously handled by specialized software in areas such as legal and financial research. This sparked a reassessment of traditional software business models.

The stocks of some large technology companies also struggled after reporting more than $100 billion in quarterly capital expenditures on AI infrastructure, raising questions about whether this spending will pay off.

Ironically, this occurred almost exactly one year after the "DeepSeek moment" in January 2025, when a Chinese AI company purportedly showed that AI models could be built at a fraction of the cost. In both cases, markets re-evaluated the winners and losers of technological change but also rebounded quickly once the dust settled. For investors, this is a reminder that keeping a long-term perspective is important as the market shifts between the opportunities from innovation and the challenges of disruption.

Technological disruption follows familiar patterns.

The current uncertainty around AI may feel unprecedented, but history shows that technological disruptions follow similar patterns. Consider how much our use of software has changed over the past few decades, evolving from something purchased in a cardboard box and installed on a single computer, to internet-enabled mobile devices, to the foundation of how we work, communicate, shop, bank, and entertain ourselves today. In every wave of innovation, there is an "old economy" and a "new economy," and markets must determine which companies fall into each category.

AI has the potential to change how services are actually created, continuing the trend of traditional processes being replaced by software. However, it's worth remembering that even the most transformative technologies don't eliminate the need for specialized expertise and services. AI systems, no matter how capable, will still require access to the best data, the most reliable platforms, and unique domain knowledge. Similarly, consumers will continue to value trust, personalization, and quality outcomes.

Which companies are most competitive in delivering these services may change over time, but the underlying fundamental needs will likely remain the same. Just as you wouldn't build a car yourself, or rebuild it every time you needed to drive to the grocery store, AI applications will still rely on existing infrastructure and specialized services. Over time, this dynamic tends to benefit consumers through smarter products, lower costs, and more accessible services.

It's also important to maintain realistic expectations about the pace of change. While AI companies have predicted the arrival of “artificial general intelligence” or “artificial super intelligence” over the past several years, recent evidence suggests that progress in AI training has slowed somewhat. That said, what current AI systems can accomplish is already remarkable and is clearly enough to reshape investor expectations.

The labor market adds to economic uncertainty.

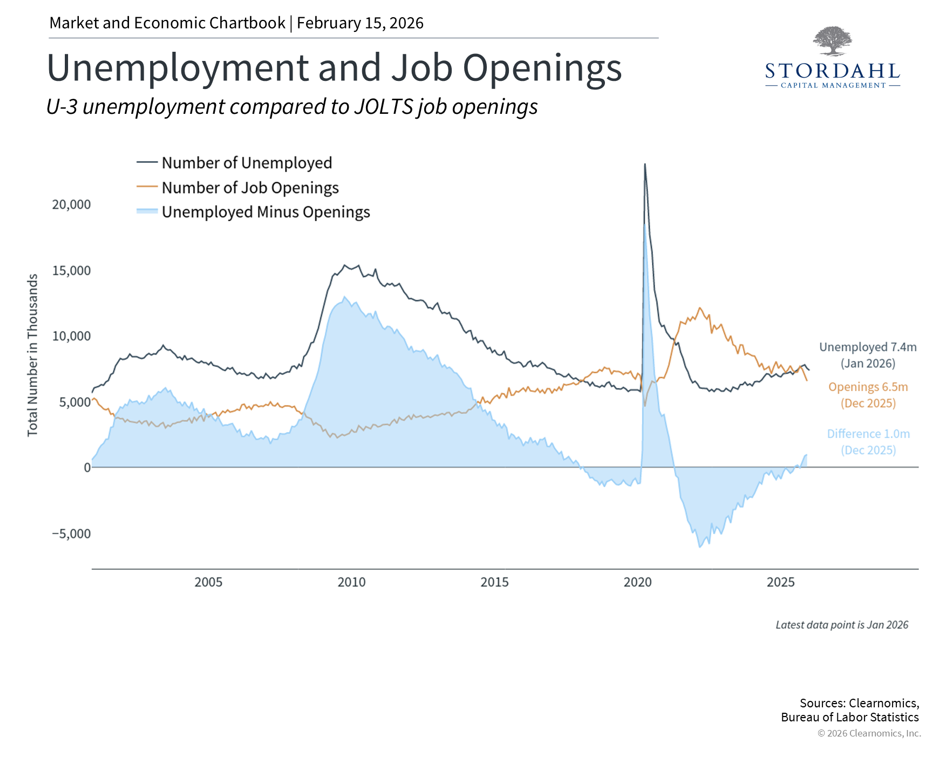

Adding to investor concerns is a labor market that has weakened since the middle of 2025.

The latest data published by the Bureau of Labor Statistics showed that job openings fell to their lowest level since 2020 in December. At its peak, there were more than two job openings per job seeker, but now the ratio is less than one, with about 6.5 million openings for 7.5 million unemployed individuals.

Meanwhile, a report by Challenger, Gray & Christmas showed that job cuts soared to 108,435 in January, a 118% year-over-year jump and the highest level for the month since 2009.

There is no direct evidence yet that these job cuts are AI-related, but these trends affect the broad economic outlook nonetheless. In the long run, every major technological wave, from the Industrial Revolution to the Information Technology Revolution, has eventually created more jobs than it replaced, but the transition periods, as workers are retrained, can be difficult for both individuals and society.

In the meantime, a weaker job market has raised concerns among some investors after years of better-than-expected economic growth. This also has implications for the broader outlook and the path of Federal Reserve policy.

It’s important to keep in mind that other economic data remain healthy, including ongoing consumer spending driven by household wealth near record levels and inflation which has held steady below 3%. So, while there are some economic challenges, there is also reason to believe the economy could continue to grow at a healthy pace.

What these trends mean for portfolios.

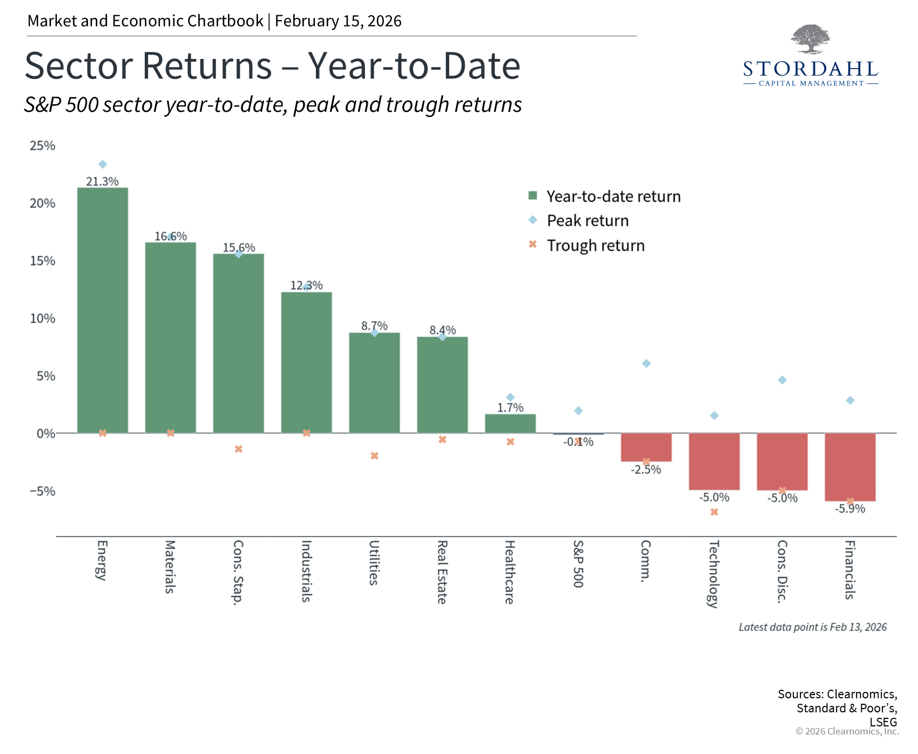

For investors, recent volatility underscores the principle that asset allocation matters more than any single trend or headline. The Information Technology and Communication Services sectors, while delivering strong returns in recent years, are also known to experience swings as expectations shift. These sectors are sensitive to long-term factors such as interest rates and are thus affected by uncertainty around the Fed.

So, while groups like the Magnificent 7 have performed well over the past several years, they can struggle in periods like 2022 just as they have over the past two months.

Perhaps the biggest question is around stock market valuations. With the S&P 500's price-to-earnings ratio near historically elevated levels, investors have been rotating into other sectors such as Consumer Staples, Energy, Materials, and Industrials.

This possibly reflects markets becoming more selective and focusing on opportunities beyond AI. After all, just because AI is the trend capturing investor attention does not mean there are not attractive opportunities across other parts of the market.

It’s worth noting that cryptocurrencies have also experienced a significant pullback in recent months, with Bitcoin falling 50% to just above $60,000 before rebounding somewhat.

This is a reminder that, from a portfolio perspective, cryptocurrencies remain highly volatile assets that can be sensitive to shifts in sentiment that often don’t have a simple explanation. For those interested in these assets, deciding how they fit into a balanced portfolio is far more important than trying to time the market.

Ultimately, today’s AI trends should be viewed in a broader context along with other changes to the market and economic landscape. If past cycles are any indication, markets will likely over- and underreact to these trends in the short run. History shows that those who can stay patient and properly invested will be best positioned to achieve their financial goals.

The bottom line? While AI is leading to a reassessment of specific stocks and sectors, the principles of long-term investing remain unchanged. Maintaining a portfolio aligned with your financial goals is still the best way to navigate periods of rapid change.

Questions? We offer a complimentary 15-minute call to discuss your concerns and explore how we can assist you.

A Weekly Perspective on Planning and Markets

Each week, we share The Week in Review — a short collection of articles on

financial planning and wealth management, along with a brief overview for context.

One email per week. No promotions, no sales – just clarity.

Stordahl Capital Management, Inc is a Registered Investment Adviser. This commentary is solely for informational purposes and reflects the personal opinions, viewpoints, and analyses of Stordahl Capital Management, Inc. and should not be regarded as a description of advisory services or performance returns of any SCM Clients. The views reflected in the commentary are subject to change at any time without notice. Nothing in this piece constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Advisory services are only offered to clients or prospective clients where Stordahl Capital Management and its representatives are properly licensed or exempt from licensure. No advice may be rendered by Stordahl Capital Management unless a client service agreement is in place. Stordahl Capital Management, Inc provides links for your convenience to websites produced by other providers or industry-related material. Accessing websites through links directs you away from our website. Stordahl Capital Management is not responsible for errors or omissions in the material on third-party websites and does not necessarily approve of or endorse the information provided. Users who gain access to third-party websites may be subject to the copyright and other restrictions on use imposed by those providers and assume responsibility and risk from the use of those websites. Please note that trading instructions through email, fax, or voicemail will not be taken. Your identity and timely retrieval of instructions cannot be guaranteed. Stordahl Capital Management, Inc. manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.

Copyright (c) 2024 Clearnomics, Inc. All rights reserved. The information contained herein has been obtained from sources believed to be reliable, but is not necessarily complete and its accuracy cannot be guaranteed. No representation or warranty, express or implied, is made as to the fairness, accuracy, completeness, or correctness of the information and opinions contained herein. The views and the other information provided are subject to change without notice. All reports posted on or via www.clearnomics.com or any affiliated websites, applications, or services are issued without regard to the specific investment objectives, financial situation, or particular needs of any specific recipient and are not to be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. Past performance is not necessarily a guide to future results. Company fundamentals and earnings may be mentioned occasionally, but should not be construed as a recommendation to buy, sell, or hold the company's stock. Predictions, forecasts, and estimates for any and all markets should not be construed as recommendations to buy, sell, or hold any security--including mutual funds, futures contracts, and exchange traded funds, or any similar instruments. The text, images, and other materials contained or displayed in this report are proprietary to Clearnomics, Inc. and constitute valuable intellectual property. All unauthorized reproduction or other use of material from Clearnomics, Inc. shall be deemed willful infringement(s) of this copyright and other proprietary and intellectual property rights, including but not limited to, rights of privacy. Clearnomics, Inc. expressly reserves all rights in connection with its intellectual property, including without limitation the right to block the transfer of its products and services and/or to track usage thereof, through electronic tracking technology, and all other lawful means, now known or hereafter devised. Clearnomics, Inc. reserves the right, without further notice, to pursue to the fullest extent allowed by the law any and all criminal and civil remedies for the violation of its rights.