The Week in Review: August 18, 2025

Tariffs Breach the First Line

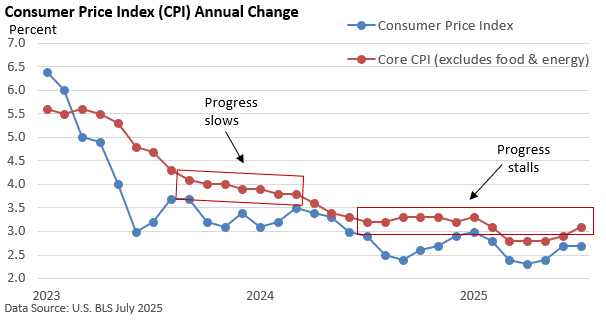

Two important measures of inflation were released last week—both by the US Bureau of Labor Statistics. First, the Consumer Price Index (CPI). It rose a modest 0.2% in July. The core CPI, which excludes food and energy, rose 0.3%. Overall, the report was okay—no significant surge in prices, but no signal that inflation is slowing down either.

More importantly, the latest CPI suggests that tariffs have yet to noticeably affect the general price level. For example, consumer goods excluding food and energy rose just 0.2%. Appliances, which jumped in June, fell sharply in July.

If we dig just under the surface, however, a different story appears to be emerging.

Rarely do we discuss the Producer Price Index (PPI), which is a measure of wholesale prices. The PPI is way out in the weeds. It is primarily a tool for economists.

July, however, was a different story. The PPI soared 0.9% in July, more than triple expectations, per the Dow Jones estimate, and the highest reading since early 2022. The core PPI also recorded an outsized 0.9% rise, triple the forecast.

The sharp rise in wholesale prices suggests that, for now, businesses are largely absorbing higher taxes on imported goods. But it puts us on notice regarding upcoming CPI releases. Inflation is a broad, persistent, and sustained rise in overall prices. Tariffs on their own aren’t necessarily inflationary—that broad, sustained rise in overall prices—unless the Fed responds with an overly loose monetary policy, like big rate cuts, at least according to economic theory.

Such a response could potentially overheat the economy or trigger a wage-price spiral, similar to the late 1960s and 1970s.

Bottom line—July’s report on wholesale prices was a surprise. However, July is simply one data point—a warning shot, but it’s still just a single point. If August gives way to a similar increase, then we can start connecting the dots; we have a line.

And if it continues for three months, well, that’s when we have a trend. With tariffs and the potential for secondary effects, it’s unclear whether any new trend might be short-lived or not. Today, investors don’t appear to be concerned.

Market Summary

TWO FOR THE ROAD

U.S. employees now rate work-life balance and personal wellbeing (59%), pay or benefits (54%), stability and job security (54%), and a job that allows them to use their strengths (48%) as most important when choosing a new job. - Gallup, February 24, 2025

You can now finance your Big Mac. That’s right… DoorDash teamed up with Klarna to let you use “buy now, pay later” to split up your fast food meals into four easy payments. What is the world coming to? Sure, it’s convenient and flexible, but one missed payment, and you could get hit with fees, a ding on your credit score, and in the end, you’re paying interest on French fries. <sigh>. - ABC News, April 28, 2025

Please do not hesitate to contact me with any questions or concerns.

I hope you have a great week!

Warmest Regards,

Bill Stordahl, CFP®

Managing Director

Stordahl Capital Management

Sources: ConstitutionCenter.org, ConstitutionFacts.com, Military.com, CNN

Stordahl Capital Management, Inc is a Registered Investment Adviser. This commentary is solely for informational purposes and reflects the personal opinions, viewpoints, and analyses of Stordahl Capital Management, Inc. and should not be regarded as a description of advisory services or performance returns of any SCM Clients. The views reflected in the commentary are subject to change at any time without notice. Nothing in this piece constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Advisory services are only offered to clients or prospective clients where Stordahl Capital Management and its representatives are properly licensed or exempt from licensure. No advice may be rendered by Stordahl Capital Management unless a client service agreement is in place. Stordahl Capital Management, Inc provides links for your convenience to websites produced by other providers or industry-related material. Accessing websites through links directs you away from our website. Stordahl Capital Management is not responsible for errors or omissions in the material on third-party websites and does not necessarily approve of or endorse the information provided. Users who gain access to third-party websites may be subject to the copyright and other restrictions on use imposed by those providers and assume responsibility and risk from the use of those websites. Please note that trading instructions through email, fax, or voicemail will not be taken. Your identity and timely retrieval of instructions cannot be guaranteed. Stordahl Capital Management, Inc. manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.

1. The Dow Jones Industrials Average is an unmanaged index of 30 major companies which cannot be invested into directly. Past performance does not guarantee future results.

2. The NASDAQ Composite is an unmanaged index of companies which cannot be invested into directly. Past performance does not guarantee future results.

3. The S&P 500 Index is an unmanaged index of 500 larger companies which cannot be invested into directly. Past performance does not guarantee future results.

4. The Global Dow is an unmanaged index composed of stocks of 150 top companies. It cannot be invested into directly. Past performance does not guarantee future results.

5. CME Group front-month contract; Prices can and do vary; past performance does not guarantee future results.

6. CME Group continuous contract; Prices can and do vary; past performance does not guarantee future results.