Market Concentration and AI: Navigating Investment Opportunities While Managing Risk

Today's investors face a unique challenge: capitalizing on artificial intelligence opportunities while avoiding excessive portfolio concentration as markets reach record levels.

Though it may be appealing to chase recent winners, sustainable wealth building demands a balanced approach that considers both potential returns and risk management.

A select group of mega-cap technology companies, collectively known as the "Magnificent 7" - Apple, Microsoft, Nvidia, Amazon, Alphabet, Meta, and Tesla - currently accounts for approximately 35% of the S&P 500's total value. These seven firms rank among the eight most valuable companies globally. Many qualify as "hyperscalers" given their substantial capital commitments to computing infrastructure supporting AI development.

During periods when a handful of stocks dominate market performance, investors benefit from examining historical precedents, evaluating current price levels, and maintaining disciplined asset allocation. Studying how previous episodes of market concentration evolved can inform more effective long-term investment strategies.

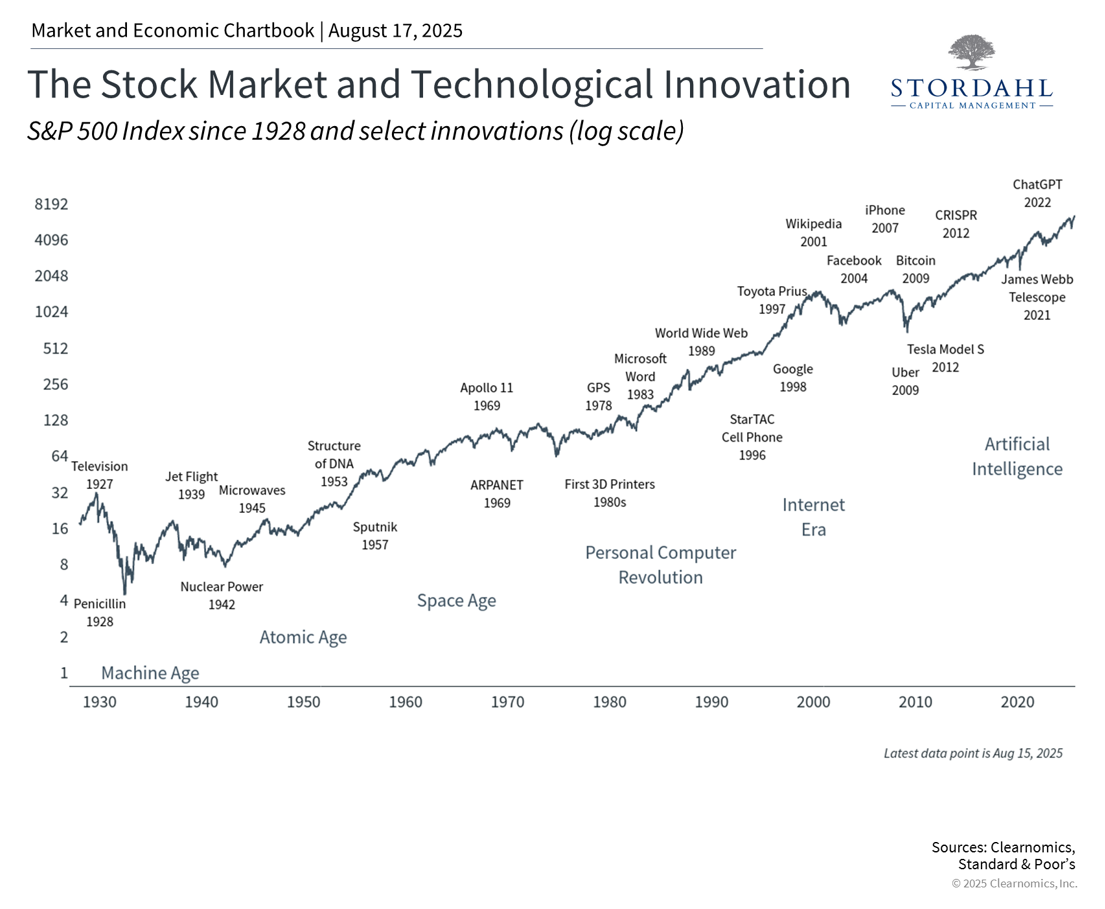

Technological breakthroughs consistently reshape markets over time

While artificial intelligence and railroad development may appear unrelated, transformative innovations typically follow remarkably similar trajectories. During the 1860s, railroad companies commanded American equity markets much as technology firms do currently. The Pennsylvania Railroad once held the distinction of being the world's most valuable company, and railway stocks collectively represented a substantial portion of the broader market. This concentration naturally generated investor excitement and elevated valuations that would seem familiar today.

This cycle has recurred throughout financial history. The late 1990s internet boom, when investors concentrated almost exclusively on web-based companies, offers perhaps the most relevant recent comparison. Looking further back, innovations like the telegraph, electric power, and telephone systems revolutionized urban centers and spawned countless new enterprises. The 20th century's electronics and computing advances fundamentally altered business and personal life well before the internet's emergence.

These technological waves consistently exhibit similar phases: initial skepticism, rapid widespread adoption, market euphoria, and eventual integration throughout the economy. Railroads didn't vanish but evolved into essential transportation and logistics infrastructure supporting economic growth. Though numerous dot-com companies collapsed during the early 2000s downturn, many survivors became today's technology giants.

For long-term investors, the focus should extend beyond individual corporations to consider how emerging technologies influence entire markets and economic systems. Innovation's true value lies in enhanced productivity and efficiency across all sectors. The crucial distinction is that while individual stock prices may fluctuate rapidly, economy-wide technological benefits typically require years or decades to fully materialize.

Historical evidence demonstrates that price levels matter alongside growth potential

The current question isn't whether artificial intelligence will prove significant, but rather whether prevailing valuations reflect realistic expectations. With the S&P 500 trading at 22.5 times earnings - approaching the historical peak of 24.5x - investors are paying premiums that assume current trends will maintain their momentum.

What factors justify elevated Magnificent 7 valuations? Recent estimates indicate U.S. private AI investment reached $109 billion in 2024, with additional hundreds of billions committed for this year.

This investment level exceeds many nations' entire economic output and significantly surpasses comparable international efforts. In recent quarters, markets have responded favorably to announcements of escalating AI infrastructure expenditures. This represents a notable shift from less than twelve months ago, when investors questioned whether such corporate investments would generate adequate returns.

Additionally, widespread adoption of AI tools by businesses and consumers has created surging demand for computational capacity. This explains why "hyperscalers" such as Microsoft and NVIDIA have achieved market capitalizations exceeding $4 trillion. It also clarifies why data center construction and the electrical power required to operate them have become central investor concerns.

These corporations are perceived as constructing the foundational infrastructure enabling other businesses to implement AI technologies, similar to how 19th-century railroad companies built transportation networks supporting all commerce. While this creates substantial long-term value, the timeline for realizing investment returns remains highly uncertain.

Markets often overestimate the speed at which revolutionary technologies will generate profits, even when long-term prospects appear genuine. The 1990s provide a relevant cautionary example. During that period, some investors believed conventional valuation methods no longer applied to internet companies. When results failed to meet expectations, the Nasdaq declined 78% from its peak, and numerous firms either failed or were acquired. Nevertheless, the internet did transform the global economy, just not within the timeframe or manner that peak valuations suggested.

Managing growth opportunities alongside concentration risks

Just as the Magnificent 7 companies have led markets higher, they have also driven significant declines. During 2022, when interest rates increased rapidly due to inflation concerns, these stocks fell approximately 50% on average.

Given that the Magnificent 7 now comprises such a substantial portion of major market indices, virtually all investors hold these stocks within their portfolios. Those who have emphasized technology investments may discover their allocations exceed intended levels.

Maintaining excessive portfolio weight in a limited number of investments creates "concentration risk," which opposes diversification principles. While these companies have demonstrated impressive growth and profitability, having a substantial portfolio exposure dependent on a small group of firms—regardless of their success—can generate volatility as market conditions shift.

Even exceptional companies experience periods of underperformance.

For context, consider the equal-weighted S&P 500 shown in the accompanying chart, which assigns identical importance to each company regardless of market capitalization. This methodology has historically produced different return patterns compared to the standard capitalization-weighted index, sometimes outperforming when large companies struggle.

Since mega-cap technology stocks have performed well recently, some investors may find it surprising that an equal-weighted approach has still delivered superior returns over the past three decades. This underscores the importance of looking beyond recent market drivers and current headlines.

This doesn't suggest investors should completely avoid technology stocks. Instead, it emphasizes the value of maintaining portfolio balance and appropriate asset allocation.

The bottom line? Artificial intelligence trends present both significant opportunities and meaningful risks for investors. Long-term financial success depends not on selecting individual winning stocks, but on maintaining balanced portfolios aligned with personal financial objectives.

Questions? We offer a complimentary 15-minute call to discuss your concerns and explore how we can assist you.

Stordahl Capital Management, Inc is a Registered Investment Adviser. This commentary is solely for informational purposes and reflects the personal opinions, viewpoints, and analyses of Stordahl Capital Management, Inc. and should not be regarded as a description of advisory services or performance returns of any SCM Clients. The views reflected in the commentary are subject to change at any time without notice. Nothing in this piece constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Advisory services are only offered to clients or prospective clients where Stordahl Capital Management and its representatives are properly licensed or exempt from licensure. No advice may be rendered by Stordahl Capital Management unless a client service agreement is in place. Stordahl Capital Management, Inc provides links for your convenience to websites produced by other providers or industry-related material. Accessing websites through links directs you away from our website. Stordahl Capital Management is not responsible for errors or omissions in the material on third-party websites and does not necessarily approve of or endorse the information provided. Users who gain access to third-party websites may be subject to the copyright and other restrictions on use imposed by those providers and assume responsibility and risk from the use of those websites. Please note that trading instructions through email, fax, or voicemail will not be taken. Your identity and timely retrieval of instructions cannot be guaranteed. Stordahl Capital Management, Inc. manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.

Copyright (c) 2024 Clearnomics, Inc. All rights reserved. The information contained herein has been obtained from sources believed to be reliable, but is not necessarily complete and its accuracy cannot be guaranteed. No representation or warranty, express or implied, is made as to the fairness, accuracy, completeness, or correctness of the information and opinions contained herein. The views and the other information provided are subject to change without notice. All reports posted on or via www.clearnomics.com or any affiliated websites, applications, or services are issued without regard to the specific investment objectives, financial situation, or particular needs of any specific recipient and are not to be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. Past performance is not necessarily a guide to future results. Company fundamentals and earnings may be mentioned occasionally, but should not be construed as a recommendation to buy, sell, or hold the company's stock. Predictions, forecasts, and estimates for any and all markets should not be construed as recommendations to buy, sell, or hold any security--including mutual funds, futures contracts, and exchange traded funds, or any similar instruments. The text, images, and other materials contained or displayed in this report are proprietary to Clearnomics, Inc. and constitute valuable intellectual property. All unauthorized reproduction or other use of material from Clearnomics, Inc. shall be deemed willful infringement(s) of this copyright and other proprietary and intellectual property rights, including but not limited to, rights of privacy. Clearnomics, Inc. expressly reserves all rights in connection with its intellectual property, including without limitation the right to block the transfer of its products and services and/or to track usage thereof, through electronic tracking technology, and all other lawful means, now known or hereafter devised. Clearnomics, Inc. reserves the right, without further notice, to pursue to the fullest extent allowed by the law any and all criminal and civil remedies for the violation of its rights.