Understanding Raytheon’s Retirement Savings Contribution (RSC)

When Raytheon froze its pension plan in 2007, it introduced a new way to help employees save for retirement: the Retirement Savings Contribution (RSC).

But many employees don’t fully understand how the RSC works — or how it fits into their long-term financial plan. If you’re eligible, this benefit can quietly add tens or even hundreds of thousands of dollars to your 401(k) over time.

Keep in Mind.

As of January 1, 2023, Raytheon (now part of RTX) transitioned away from the Retirement Savings Contribution (RSC) for most employees. It introduced a new employer contribution structure that includes a tiered company match (up to 4% of pay) and an age-based retirement contribution (3%–7%).

If you were hired before 2023 and were eligible under the previous RSC structure, you may still see historical RSC contributions in your 401(k). However, all new contributions now follow the updated formula.

Here’s what you need to know about the RSC: who gets it, how much it pays, and how to make the most of it.

What Is the RSC?

The Retirement Savings Contribution is a non-matching employer contribution to your 401(k). It’s Raytheon’s way of continuing to contribute toward your retirement after freezing the pension plan.

Unlike a match, it doesn’t depend on whether you contribute anything yourself. It’s automatic if you’re eligible.

The following information reflects the legacy RSC formula, which was in effect before January 1, 2023. While you may still see these contributions in your 401(k) history, they have been replaced by a new combined company match and retirement contribution system for active employees.

Who’s Eligible?

You’re eligible for the RSC if you were part of the pension plan before it was frozen, and you meet specific age and service criteria.

In general:

You must be a legacy Raytheon employee (hired before the RTX merger).

You must have been eligible for the pension before the freeze date (usually 2007).

You need to be actively employed and meet service requirements.

2025 Reminder: If you were receiving a grandfathered match rate as of December 31, 2022, that enhanced rate will expire on January 1, 2025. At that point, you’ll receive the standard match and contribution levels under the new plan. Please review your updated benefit statement or consult with HR to confirm your current setup.

Note: Employees hired after the pension freeze are not eligible to receive the RSC. They receive standard matching contributions only.

How Much Is It?

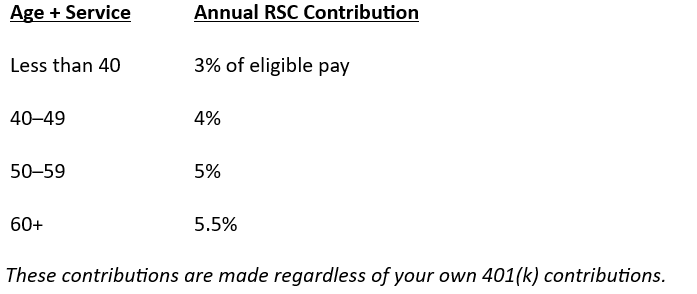

The RSC amount depends on your age and years of service, and is calculated as a percentage of your eligible compensation.

Here’s a typical structure (subject to change):

Where Does the RSC Go?

RSC contributions (if applicable in past years) were deposited into your 401(k), formerly managed by Fidelity and now administered through Alight’s ‘Your Gateway’ platform. These contributions were typically made annually in the first quarter of the following year (e.g., your 2022 RSC was deposited in early 2023). You can invest it however you like — target date funds, mutual funds, or a self-directed brokerage option. Even though the structure changed in 2023, the timing of when contributions are deposited — early the following year — has stayed the same.

Why the RSC Matters

If you’re in your 50s or 60s, the RSC can be a significant part of your retirement savings strategy, especially since:

It's guaranteed (if eligible).

It grows tax-deferred inside your 401(k).

It can compound significantly over time.

Let’s look at an example:

Example:

Jane is 58 years old, earns $130,000, and gets a 5% RSC.

Raytheon contributes $6,500 into her 401(k) each year — even if she contributes nothing.

Over 7 years, that’s $45,500 before any growth of the investment.

Common Questions

Can I increase my RSC?

No — it’s calculated and funded by the company based on their formula. You can’t increase it yourself.

Do I have to opt in?

No - it’s automatic if you’re eligible.

Is the RSC affected by how much I contribute?

No — you’ll get the RSC even if you contribute $0 to your 401(k). But contributing yourself is still smart.

Is the RSC subject to vesting?

Yes. Vesting rules vary, but if you leave the company before being vested, you may forfeit part or all of the RSC.

How to Maximize the RSC

Check your eligibility — especially if you were hired before 2007.

Coordinate with your own contributions — don’t rely on the RSC alone.

Invest it wisely — make sure your allocations match your risk profile.

Factor it into your retirement plan — use it as part of your long-term income strategy.

Final Word

The RSC is a hidden gem in Raytheon’s retirement plan — but only if you understand how to use it.

If you’re a legacy employee with pension history, the RSC might be your bridge between pension and 401(k). If you’re not sure whether you’re eligible — or how to factor it into your plan — it’s time to get clarity.

We help RTX employees prepare for retirement with confidence. Whether you need help understanding your benefits or building a full financial plan for you and your family, we’re here for you.

If you're within 5–10 years of retirement and have questions about your plan—or simply want a second opinion—we're here to help. Let's have a no-pressure conversation.

Curious about our process? Please click here.

This material was written in collaboration with artificial intelligence (ChatGPT) and derived from sources believed to be correct.

Stordahl Capital Management, Inc is a Registered Investment Adviser. This commentary is solely for informational purposes and reflects the personal opinions, viewpoints, and analyses of Stordahl Capital Management, Inc. and should not be regarded as a description of advisory services or performance returns of any SCM Clients. The views reflected in the commentary are subject to change at any time without notice. Nothing in this piece constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Advisory services are only offered to clients or prospective clients where Stordahl Capital Management and its representatives are properly licensed or exempt from licensure. No advice may be rendered by Stordahl Capital Management unless a client service agreement is in place. Stordahl Capital Management, Inc provides links for your convenience to websites produced by other providers or industry-related material. Accessing websites through links directs you away from our website. Stordahl Capital Management is not responsible for errors or omissions in the material on third-party websites and does not necessarily approve of or endorse the information provided. Users who gain access to third-party websites may be subject to the copyright and other restrictions on use imposed by those providers and assume responsibility and risk from the use of those websites. Please note that trading instructions through email, fax, or voicemail will not be taken. Your identity and timely retrieval of instructions cannot be guaranteed. Stordahl Capital Management, Inc. manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.