Understanding Credit Market Risks and Maintaining Investment Perspective

An age-old adage suggests that thieves target banks because that's where wealth resides. Yet in the modern financial landscape, capital flows through a diverse network of institutions beyond traditional banking.

Following the global financial crisis, regulatory efforts aimed at reducing bank vulnerabilities have introduced new complexities. As recent corporate failures spark worries about credit market stability, maintaining a measured outlook becomes essential for investors focused on the long term.

Post-2008, substantial lending operations have migrated toward "non-depository financial institutions" (NDFIs)—entities including private credit funds, mortgage providers, insurance firms, digital lenders, and others. These organizations differ from conventional banks primarily because they don't hold customer deposits and therefore operate outside standard banking oversight. Nevertheless, traditional banks remain interconnected with these entities, having extended approximately $1.2 trillion in loans to NDFIs.1 This arrangement introduces complexity and reduced transparency to the financial ecosystem, earning it the nickname "shadow banking."

What has brought this topic into current discussions? Recent months have seen several instances of suspected fraudulent activity among certain borrowers. September witnessed the failure of subprime auto lender Tricolor following accusations of pledging identical vehicles as collateral across multiple loans. Simultaneously, auto parts supplier First Brands filed for bankruptcy amid questions about undisclosed debt obligations.2 Most recently, allegations of fraud have surfaced involving related entities Broadband Telecom and Bridgevoice, centered on fabricated invoices utilized in asset-based financing arrangements.3

Perhaps the most widely cited reflection of market anxiety comes from JPMorgan CEO Jamie Dimon's observation that "when you see one cockroach, there are probably more." Though these isolated incidents raise legitimate concerns and have triggered temporary market volatility, the critical question centers on whether they signal systemic credit market weaknesses justifying parallels to the 2008 financial crisis or the 2023 banking turmoil.

For those investing with extended time horizons, recognizing this distinction matters significantly—effective risk management involves maintaining portfolios positioned for various scenarios rather than responding reactively to individual news items.

Historical context helps frame current market concerns appropriately

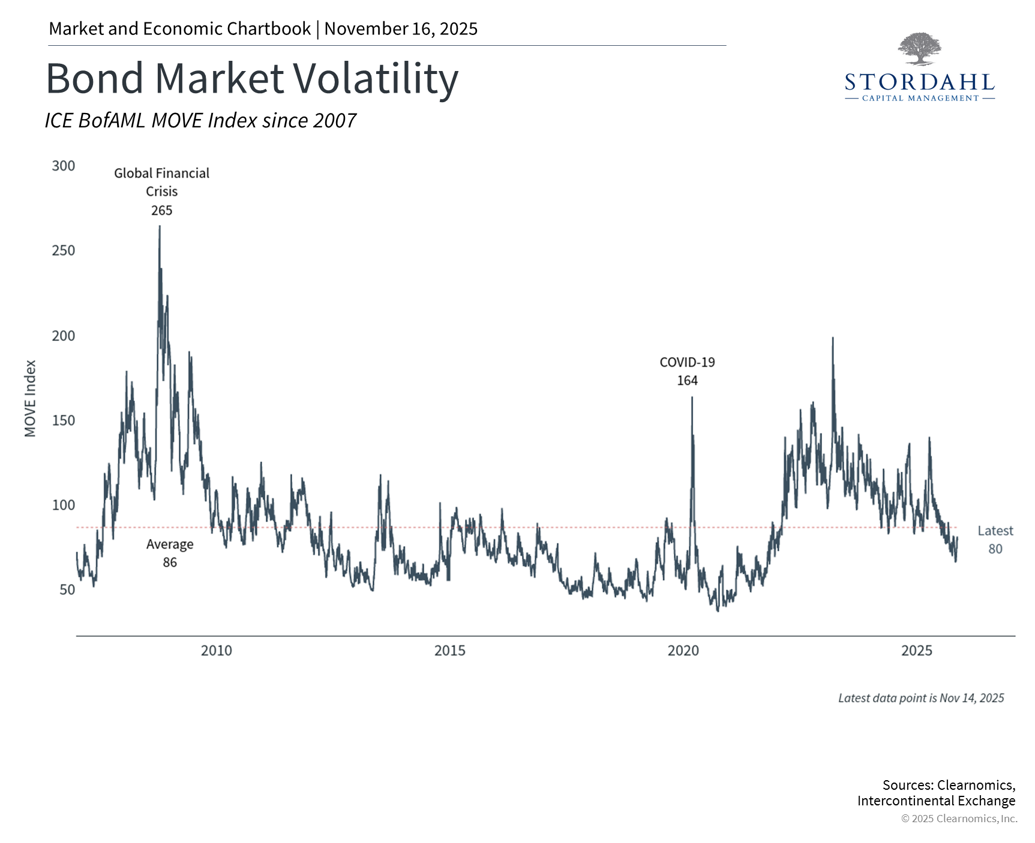

When credit challenges surface, drawing parallels to 2008 or 2023 comes naturally. Although fraudulent activities were uncovered during the 2008 financial crisis, what transformed those situations into systemic threats wasn't the fraud itself or even the housing market collapse—it was the extraordinary financial leverage concentrated among major institutions. Frequently, these leveraged exposures exceeded the equity capital maintained by each firm, creating widespread financial system disruption.

The 2023 banking crisis offers perhaps a more applicable comparison, as multiple regional banks collapsed in rapid succession. That episode exposed a distinct vulnerability: the disconnect between bank assets and liabilities as interest rates climbed sharply. These institutions served concentrated client bases—technology startups for Silicon Valley Bank, cryptocurrency firms for Signature Bank and Silvergate—making them susceptible to industry-specific difficulties.

Despite initial worries, that situation didn't cascade into broader economic weakness. Nevertheless, the 2023 episode illustrates how swiftly market confidence can deteriorate in contemporary financial markets, only to recover. Consistently, these historical examples underscore the value of measured responses to emerging news.

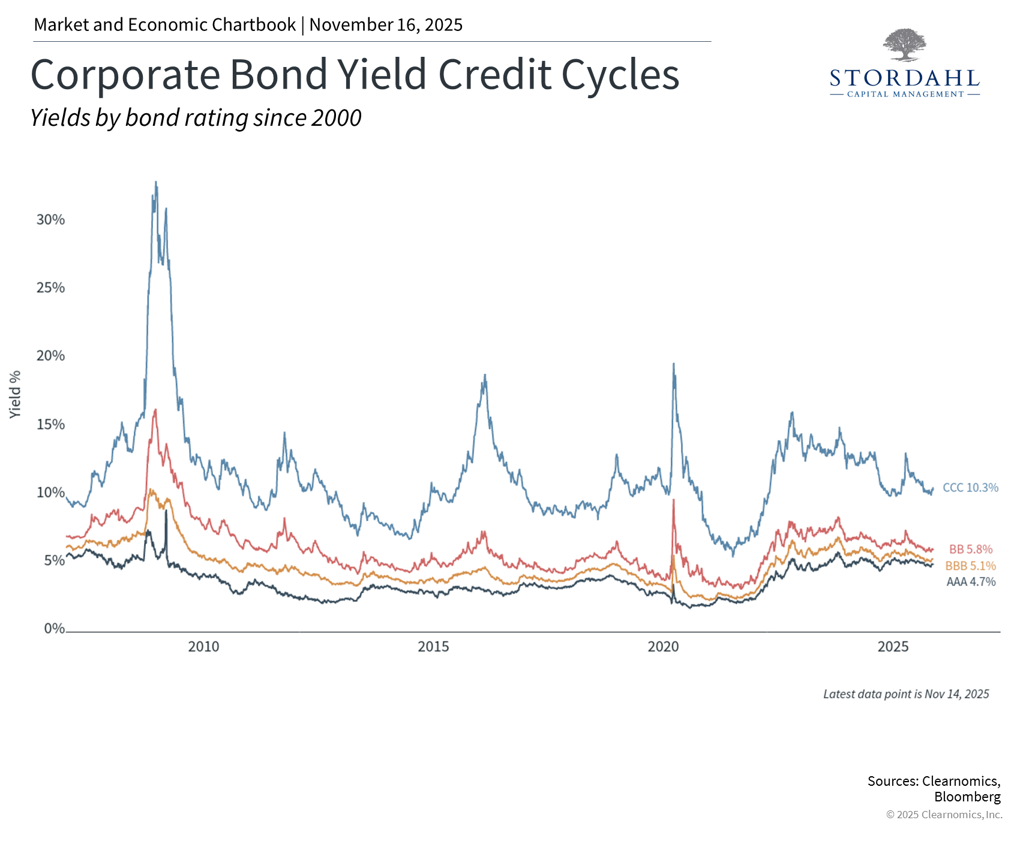

The chart shown illustrates both past credit disruptions and the current stability in bond yields and spreads.

Credit cycles play central roles in economic transitions

Historically, credit and debt cycles have frequently driven the most substantial economic expansions and contractions. Periods of ample financial system liquidity typically see increased credit extension to both corporate borrowers and consumers. This recurring pattern of lending and borrowing during growth phases spans various historical periods—from nineteenth-century railroad expansion through the roaring twenties to the mid-2000s housing boom.

Yet distinguishing between the viewpoint of major financial institutions and that of long-term investors remains important. For large banks, individual loan performance impacts quarterly results through potential write-downs. For investors, the crucial consideration is whether problems are "systemic," influencing the wider economy and diversified investment portfolios.

The situation continues developing, and additional instances of fraud and problem loans may surface. Markets have already stabilized following initial bankruptcy announcements, however, and several important factors deserve consideration.

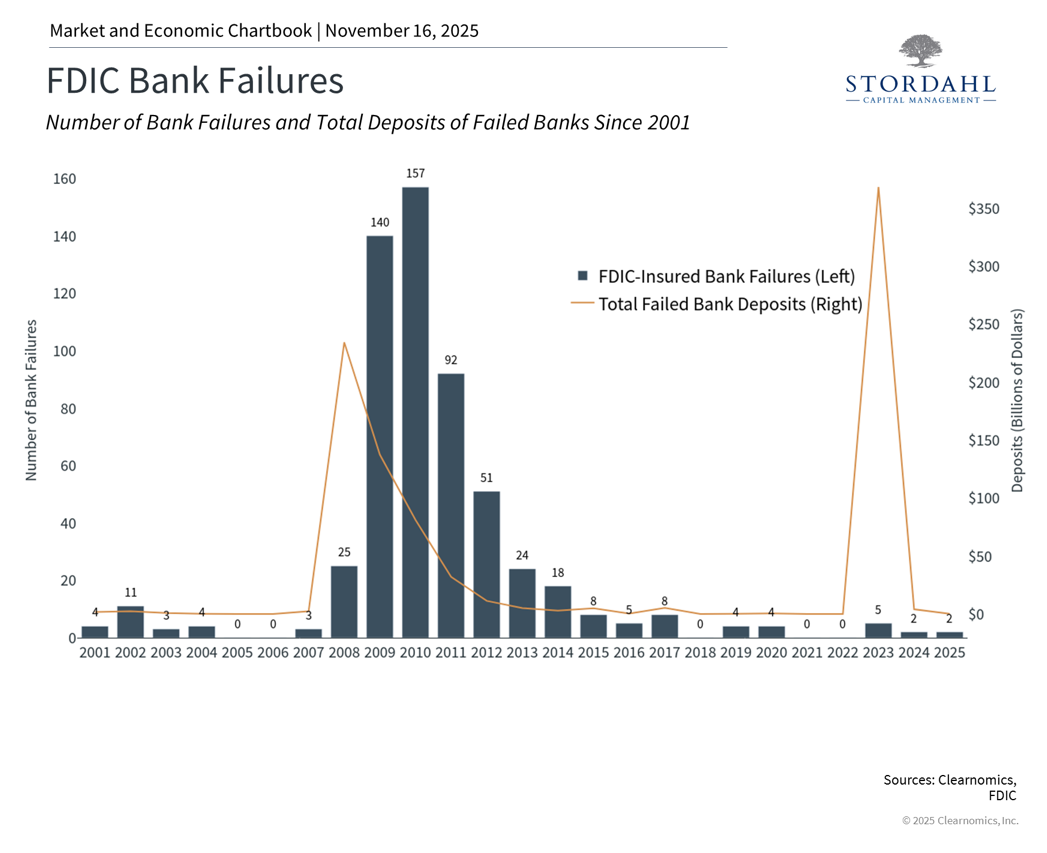

First, while substantial for affected institutions, the dollar values involved constitute a modest portion of the overall financial system. Second, major banks generally maintain strong capital positions and diversification across numerous lending sectors, limiting exposure to difficulties in any particular area. Third, unlike previous crises, no evidence currently suggests broader economic stress that would trigger widespread credit deterioration. The accompanying chart demonstrates enhanced banking system stability over recent years.

Equity and fixed income markets have maintained relative stability

Equity and bond markets have encountered intermittent uncertainty in recent months, influenced by tariffs, government shutdown concerns, financial sector worries, and questions surrounding artificial intelligence investments. Despite this backdrop, major equity indices have continued establishing fresh record highs, while fixed income returns have contributed positively to balanced portfolio performance.

For investors maintaining long-term perspectives, the essential takeaway is that recent headlines regarding financial fraud and bankruptcies represent normal features of credit cycles and market functioning. While specific cases merit attention, their significance differs from whether they threaten the broader financial infrastructure. Regardless, adjustments will clearly be required among lenders, particularly those operating outside traditional banking frameworks.

The bottom line? Recent credit challenges involving private lenders have generated concern, though markets have stabilized in recent weeks. For long-term investors, these developments underscore the value of risk management approaches that align portfolios with enduring objectives.

Questions? We offer a complimentary 15-minute call to discuss your concerns and explore how we can assist you.

References

Stordahl Capital Management, Inc is a Registered Investment Adviser. This commentary is solely for informational purposes and reflects the personal opinions, viewpoints, and analyses of Stordahl Capital Management, Inc. and should not be regarded as a description of advisory services or performance returns of any SCM Clients. The views reflected in the commentary are subject to change at any time without notice. Nothing in this piece constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Advisory services are only offered to clients or prospective clients where Stordahl Capital Management and its representatives are properly licensed or exempt from licensure. No advice may be rendered by Stordahl Capital Management unless a client service agreement is in place. Stordahl Capital Management, Inc provides links for your convenience to websites produced by other providers or industry-related material. Accessing websites through links directs you away from our website. Stordahl Capital Management is not responsible for errors or omissions in the material on third-party websites and does not necessarily approve of or endorse the information provided. Users who gain access to third-party websites may be subject to the copyright and other restrictions on use imposed by those providers and assume responsibility and risk from the use of those websites. Please note that trading instructions through email, fax, or voicemail will not be taken. Your identity and timely retrieval of instructions cannot be guaranteed. Stordahl Capital Management, Inc. manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.

Copyright (c) 2024 Clearnomics, Inc. All rights reserved. The information contained herein has been obtained from sources believed to be reliable, but is not necessarily complete and its accuracy cannot be guaranteed. No representation or warranty, express or implied, is made as to the fairness, accuracy, completeness, or correctness of the information and opinions contained herein. The views and the other information provided are subject to change without notice. All reports posted on or via www.clearnomics.com or any affiliated websites, applications, or services are issued without regard to the specific investment objectives, financial situation, or particular needs of any specific recipient and are not to be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. Past performance is not necessarily a guide to future results. Company fundamentals and earnings may be mentioned occasionally, but should not be construed as a recommendation to buy, sell, or hold the company's stock. Predictions, forecasts, and estimates for any and all markets should not be construed as recommendations to buy, sell, or hold any security--including mutual funds, futures contracts, and exchange traded funds, or any similar instruments. The text, images, and other materials contained or displayed in this report are proprietary to Clearnomics, Inc. and constitute valuable intellectual property. All unauthorized reproduction or other use of material from Clearnomics, Inc. shall be deemed willful infringement(s) of this copyright and other proprietary and intellectual property rights, including but not limited to, rights of privacy. Clearnomics, Inc. expressly reserves all rights in connection with its intellectual property, including without limitation the right to block the transfer of its products and services and/or to track usage thereof, through electronic tracking technology, and all other lawful means, now known or hereafter devised. Clearnomics, Inc. reserves the right, without further notice, to pursue to the fullest extent allowed by the law any and all criminal and civil remedies for the violation of its rights.