The Week in Review: June 23, 2025

The Fed Hits Snooze on Policy Moves

It came as no surprise that the Federal Reserve maintained its benchmark rate—the fed funds rate—at 4.25% to 4.50% during last Wednesday’s meeting. Despite the moderation in the rate of inflation, central bankers didn’t hint at any near-term cut in interest rates.

The meeting can be summed up in a few remarks that were centered on tariffs. So, in Fed Chief Powell’s own words—

“The pass-through of tariffs to consumer price inflation is a whole process that's very uncertain. As you know, there are many parties in that chain,” Powell said at his Wednesday afternoon press conference.

“There's the manufacturer, exporter, importer, retailer, and consumer. And each one of those is going to be trying not to be the one to pay for the tariff. But together they will all pay. Or maybe one party will pay it all.

“But that process is very hard to predict. We haven't been through a situation like this. I think we have to be humble about our ability to forecast it. So that's why we need to see some actual data to make better decisions.”

His remarks can be framed as intentional ambiguity or calculated imprecision. Or, perhaps he’s preserving flexibility, avoiding a definitive stance that might need to be reversed. Fed officials are still mindful of how badly they misjudged inflation in 2021 when they labeled it ‘transitory.’

A revival of inflation remains a concern among policymakers. “The thing that every outside forecaster and the Fed is saying is that we expect a meaningful amount of inflation (my emphasis) to arrive in the coming months... One of our jobs is to make sure that a one-time increase in inflation doesn't turn into an inflation problem,” Powell said.

While the Fed’s own forecast suggests we may see two rate cuts later in the year, barring unexpected cracks in the labor market, i.e., a jump in layoffs, a rise in the unemployment rate, or weak payroll growth, for now the Fed is in a patient, wait-and-see mode.

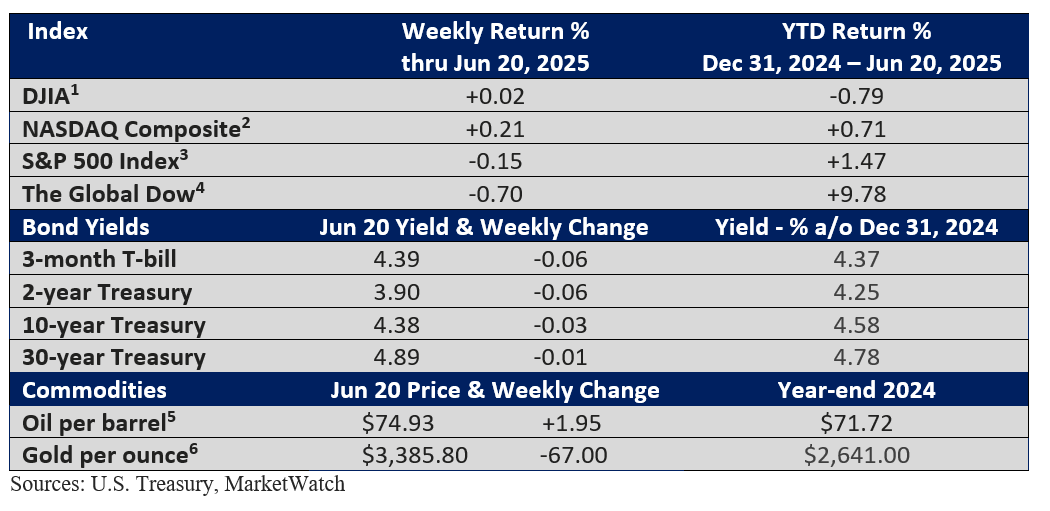

Market Summary

Please do not hesitate to contact me with any questions or concerns.

I hope you have a great week!

Bill Stordahl, CFP®

Managing Director

Stordahl Capital Management

Stordahl Capital Management, Inc is a Registered Investment Adviser. This commentary is solely for informational purposes and reflects the personal opinions, viewpoints, and analyses of Stordahl Capital Management, Inc. and should not be regarded as a description of advisory services or performance returns of any SCM Clients. The views reflected in the commentary are subject to change at any time without notice. Nothing in this piece constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Advisory services are only offered to clients or prospective clients where Stordahl Capital Management and its representatives are properly licensed or exempt from licensure. No advice may be rendered by Stordahl Capital Management unless a client service agreement is in place. Stordahl Capital Management, Inc provides links for your convenience to websites produced by other providers or industry-related material. Accessing websites through links directs you away from our website. Stordahl Capital Management is not responsible for errors or omissions in the material on third-party websites and does not necessarily approve of or endorse the information provided. Users who gain access to third-party websites may be subject to the copyright and other restrictions on use imposed by those providers and assume responsibility and risk from the use of those websites. Please note that trading instructions through email, fax, or voicemail will not be taken. Your identity and timely retrieval of instructions cannot be guaranteed. Stordahl Capital Management, Inc. manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.

1. The Dow Jones Industrials Average is an unmanaged index of 30 major companies which cannot be invested into directly. Past performance does not guarantee future results.

2. The NASDAQ Composite is an unmanaged index of companies which cannot be invested into directly. Past performance does not guarantee future results.

3. The S&P 500 Index is an unmanaged index of 500 larger companies which cannot be invested into directly. Past performance does not guarantee future results.

4. The Global Dow is an unmanaged index composed of stocks of 150 top companies. It cannot be invested into directly. Past performance does not guarantee future results.

5. CME Group front-month contract; Prices can and do vary; past performance does not guarantee future results.

6. CME Group continuous contract; Prices can and do vary; past performance does not guarantee future results.