The Week in Review: January 29, 2024

Blistering Pace

During the Civil War, the Union placed a blockade on Confederate ports. In August 1864, David Farragut was given the task of closing the port at Mobile, Alabama, which had defied the order.

When Farragut ordered his fleet to proceed, one of the ships hit a mine and sank, causing the rest of the fleet to hesitate. However, Farragut was undeterred and famously exclaimed, "Damn the torpedoes! Four bells! Captain Drayton, go ahead! Jouett, full speed!".

Today’s economy has a similar ring to it. Despite higher interest rates and higher inflation, it’s a “damn the torpedoes, full speed ahead” economy.

Last week’s GDP number reflected such brashness. The U.S. Bureau of Economic Analysts (BEA) reported that Q4 Gross Domestic Product (GDP), the largest measure of goods and services, expanded at an annual pace of 3.3%, easily topping the 2.0% forecast (Investor’s Business Daily).

Across the board, internal metrics were upbeat, including consumer spending, which accounts for just under 70% of GDP.

Though we’ve heard that consumers are shifting away from goods and toward experiences/services/entertainment, the data suggest otherwise.

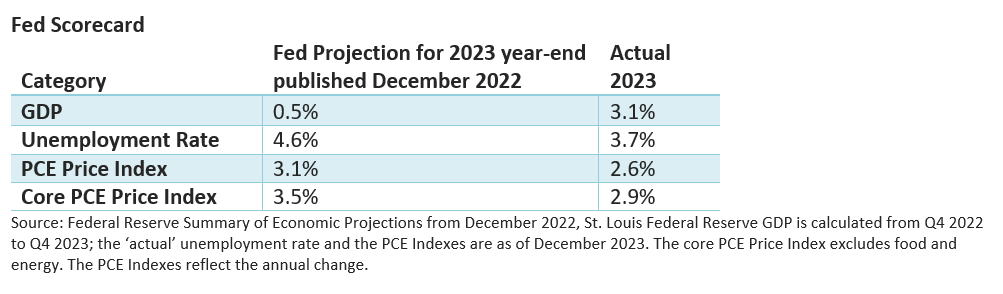

The table below summarizes the Federal Reserve's December 2022 forecast. Despite sharp rate hikes, the data has been better than expected. GDP exceeded a weak forecast, the unemployment rate held below 4%, and the inflation rate fell faster than expected.

Investors have benefited from robust economic growth, which supports corporate profits, while the slowdown in inflation has kept interest rates in check.

Market Summary

Two For the road

In the late 1970s, roughly 70% of U.S. imported oil came from OPEC. That was down to about 15% at the end of 2022. - Axios, January 18, 2024

Unemployment has now been under 4% for almost two years- the longest streak of rock-bottom jobless rates since the Vietnam War. - NPR, January 5, 2024

Please do not hesitate to contact me with any questions or concerns. I hope you have a wonderful week!

Bill Stordahl, CFP®

Managing Director

Stordahl Capital Management

Stordahl Capital Management, Inc is a Registered Investment Adviser. This commentary is solely for informational purposes and reflects the personal opinions, viewpoints, and analyses of Stordahl Capital Management, Inc. and should not be regarded as a description of advisory services or performance returns of any SCM Clients. The views reflected in the commentary are subject to change at any time without notice. Nothing in this piece constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Advisory services are only offered to clients or prospective clients where Stordahl Capital Management and its representatives are properly licensed or exempt from licensure. No advice may be rendered by Stordahl Capital Management unless a client service agreement is in place. Stordahl Capital Management, Inc provides links for your convenience to websites produced by other providers or industry-related material. Accessing websites through links directs you away from our website. Stordahl Capital Management is not responsible for errors or omissions in the material on third-party websites and does not necessarily approve of or endorse the information provided. Users who gain access to third-party websites may be subject to the copyright and other restrictions on use imposed by those providers and assume responsibility and risk from the use of those websites. Please note that trading instructions through email, fax, or voicemail will not be taken. Your identity and timely retrieval of instructions cannot be guaranteed. Stordahl Capital Management, Inc. manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.

1. The Dow Jones Industrials Average is an unmanaged index of 30 major companies which cannot be invested into directly. Past performance does not guarantee future results.

2. The NASDAQ Composite is an unmanaged index of companies which cannot be invested into directly. Past performance does not guarantee future results.

3. The S&P 500 Index is an unmanaged index of 500 larger companies which cannot be invested into directly. Past performance does not guarantee future results.

4. The Global Dow is an unmanaged index composed of stocks of 150 top companies. It cannot be invested into directly. Past performance does not guarantee future results.

5. CME Group front-month contract; Prices can and do vary; past performance does not guarantee future results.

6. CME Group continuous contract; Prices can and do vary; past performance does not guarantee future results.