The Week in Review: January 26, 2026

It’s Hard to Say Good-bye: What Persistently Low Layoffs Say About the Economy

Much has been made of the sluggish hiring environment, but less attention has been paid to an important counterpoint: the persistently low level of layoffs.

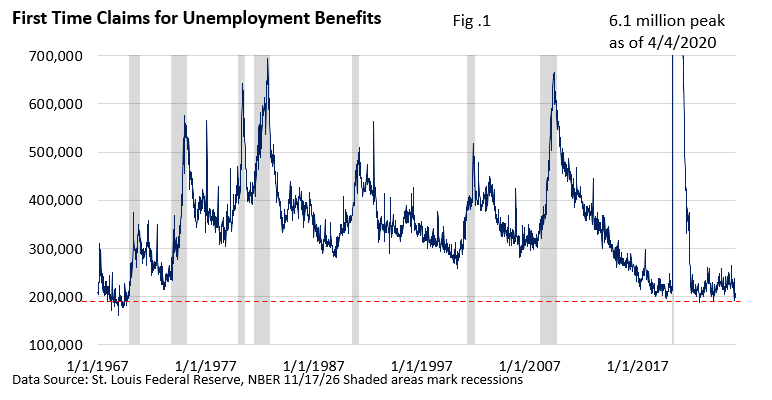

Figure 1 highlights the number of individuals who go online or head to their respective state’s unemployment office and file for benefits following a layoff.

At 200,000 in the week ended January 17, claims are near a historic low.

Not surprisingly, layoffs peak in a recession, and the severity of the recession plays a big role in the level.

It’s curious that the low reading persists despite high-profile layoff announcements. Perhaps severance packages may delay filings, while others who lose jobs may find refuge in other departments at their company.

Low layoffs are an important economic gauge as it’s a reliable indicator that companies are reluctant to lose employees due to the demand for the goods and services they offer.

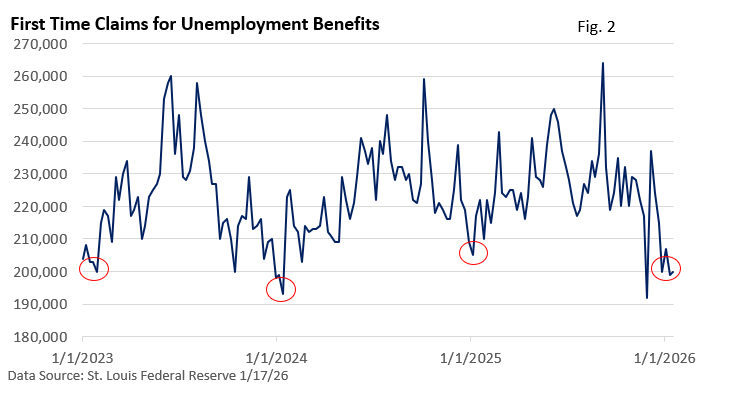

That said, filings tend to decline in January—Figure 2—which may simply reflect seasonal quirks in the data rather than a recent, positive shift in labor‑market dynamics.

If this seasonal pattern persists, filings may edge modestly higher in the weeks ahead. Still, the move back toward the lower end of the annual range is encouraging and, on its own, does not signal underlying economic weakness.

In summary, layoffs never disappear entirely, but workers filing for benefits remains low.

That is a constructive signal for both the labor market and the broader economy. In turn, sustained economic growth provides underlying support for corporate profits.

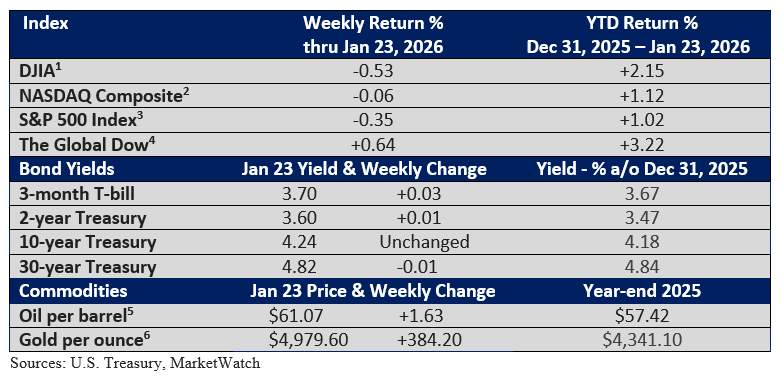

Market Summary

Please let me know if you have any questions or concerns that you would like to discuss.

I hope you have a wonderful week!

Warmest Regards,

Bill Stordahl, CFP®

Managing Director

Stordahl Capital Management

Stordahl Capital Management, Inc is a Registered Investment Adviser. This commentary is solely for informational purposes and reflects the personal opinions, viewpoints, and analyses of Stordahl Capital Management, Inc. and should not be regarded as a description of advisory services or performance returns of any SCM Clients. The views reflected in the commentary are subject to change at any time without notice. Nothing in this piece constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Advisory services are only offered to clients or prospective clients where Stordahl Capital Management and its representatives are properly licensed or exempt from licensure. No advice may be rendered by Stordahl Capital Management unless a client service agreement is in place. Stordahl Capital Management, Inc provides links for your convenience to websites produced by other providers or industry-related material. Accessing websites through links directs you away from our website. Stordahl Capital Management is not responsible for errors or omissions in the material on third-party websites and does not necessarily approve of or endorse the information provided. Users who gain access to third-party websites may be subject to the copyright and other restrictions on use imposed by those providers and assume responsibility and risk from the use of those websites. Please note that trading instructions through email, fax, or voicemail will not be taken. Your identity and timely retrieval of instructions cannot be guaranteed. Stordahl Capital Management, Inc. manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.

1. The Dow Jones Industrials Average is an unmanaged index of 30 major companies which cannot be invested into directly. Past performance does not guarantee future results.

2. The NASDAQ Composite is an unmanaged index of companies which cannot be invested into directly. Past performance does not guarantee future results.

3. The S&P 500 Index is an unmanaged index of 500 larger companies which cannot be invested into directly. Past performance does not guarantee future results.

4. The Global Dow is an unmanaged index composed of stocks of 150 top companies. It cannot be invested into directly. Past performance does not guarantee future results.

5. CME Group front-month contract; Prices can and do vary; past performance does not guarantee future results.

6. CME Group continuous contract; Prices can and do vary; past performance does not guarantee future results.