The Week in Review: January 19, 2026

Forks, Knives, and Economic Clues

Let’s review one narrow economic indicator that provides a useful, though not standalone, measure of the overall economy’s health.

The US Census categorizes it as ‘food services and drinking places.’ That can best be described as restaurants and bars.

When the economy is riding high, most people feel optimistic and are more inclined to make discretionary purchases—non-essential items or services. This would include eating out.

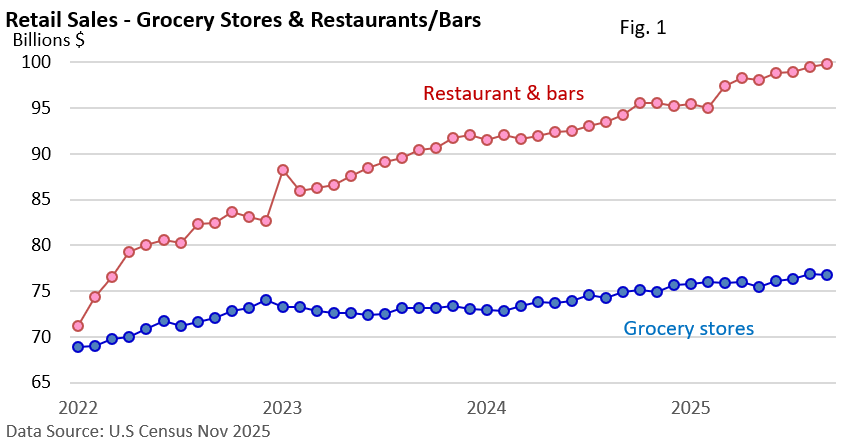

As highlighted in Figure 1, eating out has far outpaced grocery purchases over the last four years. Notably, the upbeat pace has continued in recent months, suggesting an expanding economy.

One drawback in Figure 1 is that it’s not adjusted for inflation. Plus, restaurant inflation has outpaced overall inflation, as measured by the US BLS’ Consumer Price Index. Gains may simply be due to rising menu prices.

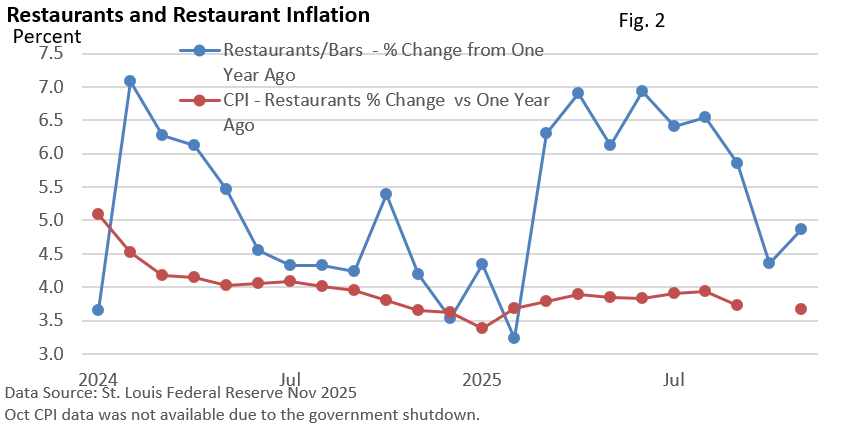

Figure 2 attempts to adjust for inflation by comparing the annual change in sales at restaurants with the annual change in the CPI for eating out. Given that adjustment, sales are outpacing inflation in all but two months.

As we look to 2026, a sluggish hiring picture could dampen economic activity, while recent Fed rate cuts and fiscal stimulus in the just-passed tax bill seem set to support the economy next year.

This is not a sign of economic weakness, despite sluggish hiring and consumer confidence surveys that reflect a gloomy mood. If economic anxiety were a big concern, we’d probably see weakness in this indicator, like fewer trips out or people switching to cheaper restaurants.

That’s not the case. As with any anecdotal measures of economic activity, it must be paired with broader economic reports. Today, most economic data is signaling an expanding economy.

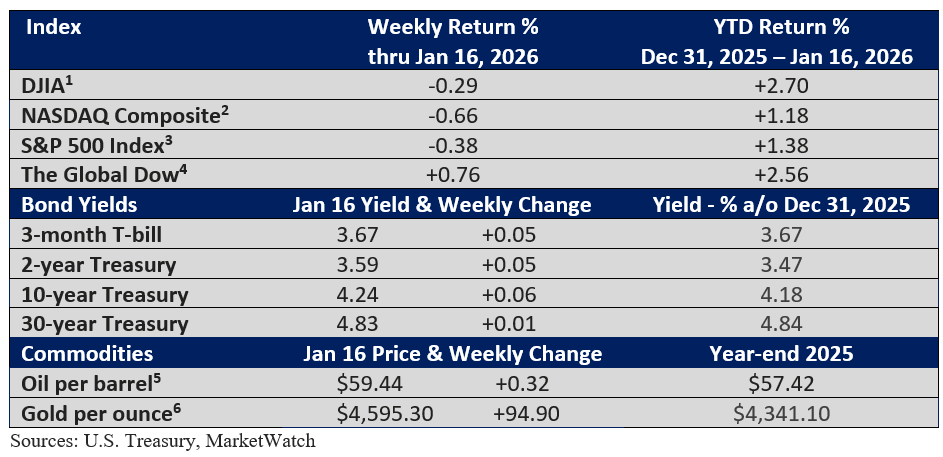

Market Summary

TWO FOR THE ROAD

The human brain uses roughly 20 watts of power (about the same as a dim light bulb) yet can outperform many AI systems that require thousands of watts to run. Researchers say this efficiency gap is one of the biggest unsolved challenges in artificial intelligence. - Science Daily, March 27, 2025

“Wealth is not about having a lot of money – it’s about having a lot of options.” - Chris Rock

Please let me know if you have any questions or concerns that you would like to discuss.

I hope you have a wonderful week!

Warmest Regards,

Bill Stordahl, CFP®

Managing Director

Stordahl Capital Management

Stordahl Capital Management, Inc is a Registered Investment Adviser. This commentary is solely for informational purposes and reflects the personal opinions, viewpoints, and analyses of Stordahl Capital Management, Inc. and should not be regarded as a description of advisory services or performance returns of any SCM Clients. The views reflected in the commentary are subject to change at any time without notice. Nothing in this piece constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Advisory services are only offered to clients or prospective clients where Stordahl Capital Management and its representatives are properly licensed or exempt from licensure. No advice may be rendered by Stordahl Capital Management unless a client service agreement is in place. Stordahl Capital Management, Inc provides links for your convenience to websites produced by other providers or industry-related material. Accessing websites through links directs you away from our website. Stordahl Capital Management is not responsible for errors or omissions in the material on third-party websites and does not necessarily approve of or endorse the information provided. Users who gain access to third-party websites may be subject to the copyright and other restrictions on use imposed by those providers and assume responsibility and risk from the use of those websites. Please note that trading instructions through email, fax, or voicemail will not be taken. Your identity and timely retrieval of instructions cannot be guaranteed. Stordahl Capital Management, Inc. manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.

1. The Dow Jones Industrials Average is an unmanaged index of 30 major companies which cannot be invested into directly. Past performance does not guarantee future results.

2. The NASDAQ Composite is an unmanaged index of companies which cannot be invested into directly. Past performance does not guarantee future results.

3. The S&P 500 Index is an unmanaged index of 500 larger companies which cannot be invested into directly. Past performance does not guarantee future results.

4. The Global Dow is an unmanaged index composed of stocks of 150 top companies. It cannot be invested into directly. Past performance does not guarantee future results.

5. CME Group front-month contract; Prices can and do vary; past performance does not guarantee future results.

6. CME Group continuous contract; Prices can and do vary; past performance does not guarantee future results.