The Week in Review: February 9, 2026

Markets Rotate: What’s Driving the Shift; Plus, the Dow Crosses a Milestone

After leading markets for much of the past two years, AI, tech stocks, and software specifically, are losing leadership in early 2026, as investors rotate capital toward other sectors, including energy, industrials, and defensive sectors. This shift is not the result of a single bad earnings season or a collapse in AI demand. In fact, the opposite is true based on a strong start to Q4 earnings season.

Instead, it has been a repricing of risk and valuations. It’s a 2026 reset, triggered partly by AI itself.

At the center of the recent move is the concern that rapid advances in AI are disrupting traditional software economics faster than expected.

Recent releases from AI developers, particularly Anthropic’s plug‑ins and Claude Opus 4.6, have raised concerns that certain software‑as‑a‑service models may face pricing pressure or declining demand, as autonomous “agent” tools take on legal, analytical, and administrative work.

It’s not new. Concerns have simmered for months, especially worries within the software sector.

Yet, while recent earnings reports have been strong, shorter-term investors have focused on various metrics in the reports or remarks from post-earnings conference calls with company executives.

Meanwhile, exceptionally strong demand for memory chips used in AI data centers may constrain growth for other technology firms, as shortages and delays in key components make it harder to scale production and meet demand.

Moreover, some investors are starting to question the staggering capital expenditures of hyperscalers, which are companies that operate and build massive, globally distributed data‑center infrastructure.

Why are major tech firms set to pour hundreds of billions of dollars into data centers this year? Demand for AI is strong, and investments are being made to meet growth today and tomorrow.

Nvidia’s (NVDA $184) CEO Jensen Huang told CNBC on Friday that surging capital expenditures for AI infrastructure are justified, appropriate, and sustainable. He said the AI buildout is being driven by “sky-high” demand for computing power.

Yet, there are anxieties in some quarters that excessive spending could create too much capacity, making it harder to monetize those expenditures and potentially dampening future profits.

With interest rates remaining higher for longer, investors are less willing to pay premium prices for long‑term growth. Instead, recent money has flowed into other industries that may benefit from tighter supply, infrastructure investment, and geopolitical demand.

As a result, sectors that had been ignored have recently benefited.

While AI remains a powerful long‑term theme, the market is signaling that not all tech and software companies will be winners, highlighting the importance of diversification.

Nonetheless, to put the recent volatility in context, the S&P 500 is down just 2.58% from its January 27 peak to Thursday’s most recent low (MarketWatch data). And on Friday, the Dow Jones Industrials surpassed and closed above 50,000 for the first time in its history.

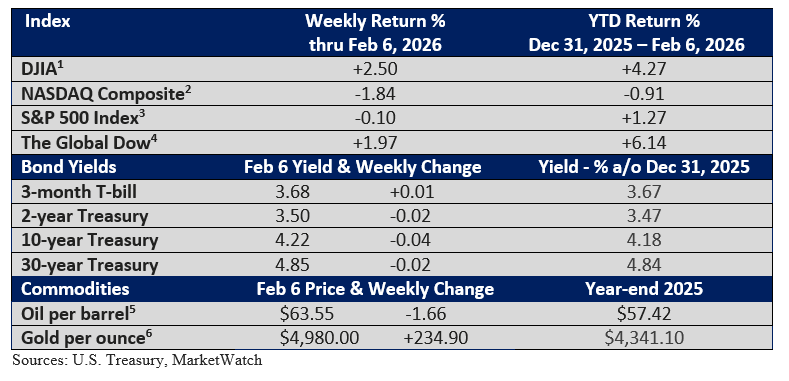

Market Summary

Two FOR THE ROAD

Of the largest 10 stocks in the S&P500 in 1985, none are still in the top 10 today.

- Visual Capitalist, April 10, 2025"We tend to overestimate the effect of a technology in the short run and underestimate the effect in the long run." - Roy Amara

Please let me know if you have any questions or concerns that you would like to discuss.

I hope you have a wonderful week!

Warmest Regards,

Bill Stordahl, CFP®

Managing Director

Stordahl Capital Management

A Weekly Perspective on Planning and Markets

Each week, we share The Week in Review — a short collection of articles on

financial planning and wealth management, along with a brief overview for context.

One email per week. No promotions, no sales – just clarity.

Stordahl Capital Management, Inc is a Registered Investment Adviser. This commentary is solely for informational purposes and reflects the personal opinions, viewpoints, and analyses of Stordahl Capital Management, Inc. and should not be regarded as a description of advisory services or performance returns of any SCM Clients. The views reflected in the commentary are subject to change at any time without notice. Nothing in this piece constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Advisory services are only offered to clients or prospective clients where Stordahl Capital Management and its representatives are properly licensed or exempt from licensure. No advice may be rendered by Stordahl Capital Management unless a client service agreement is in place. Stordahl Capital Management, Inc provides links for your convenience to websites produced by other providers or industry-related material. Accessing websites through links directs you away from our website. Stordahl Capital Management is not responsible for errors or omissions in the material on third-party websites and does not necessarily approve of or endorse the information provided. Users who gain access to third-party websites may be subject to the copyright and other restrictions on use imposed by those providers and assume responsibility and risk from the use of those websites. Please note that trading instructions through email, fax, or voicemail will not be taken. Your identity and timely retrieval of instructions cannot be guaranteed. Stordahl Capital Management, Inc. manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.

1. The Dow Jones Industrials Average is an unmanaged index of 30 major companies which cannot be invested into directly. Past performance does not guarantee future results.

2. The NASDAQ Composite is an unmanaged index of companies which cannot be invested into directly. Past performance does not guarantee future results.

3. The S&P 500 Index is an unmanaged index of 500 larger companies which cannot be invested into directly. Past performance does not guarantee future results.

4. The Global Dow is an unmanaged index composed of stocks of 150 top companies. It cannot be invested into directly. Past performance does not guarantee future results.

5. CME Group front-month contract; Prices can and do vary; past performance does not guarantee future results.

6. CME Group continuous contract; Prices can and do vary; past performance does not guarantee future results.