The Week in Review: February 2, 2026

January Barometer Flashes Green, a Sleepy Fed Gathering

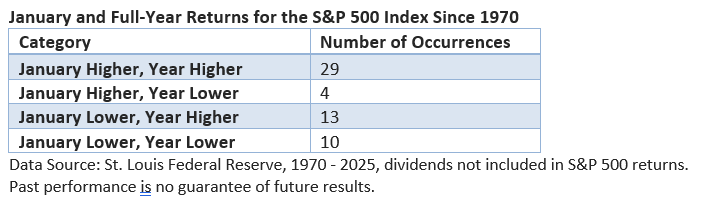

The so-called January Barometer holds that the market’s performance in January—measured by the S&P 500 Index—tends to foreshadow how stocks will perform during the year.

Since 1970, January finished higher 33 times and fell 23 times, excluding this month’s increase of 1.37% (MarketWatch data, excludes reinvested dividends).

How accurate is the barometer? As illustrated in the table below, a positive January, coupled with a positive year, occurred 29 times since 1970. Simply put, when January finished higher, the S&P 500 gained ground 29 times. The average increase: 19%.

There were only four years in which January was positive, but the year finished lower. The average loss was 5.2%.

When January finishes in the green, the January Barometer has been a ringing endorsement for the full year, though less not discount the possibility of market pullbacks, as we saw in 2025.

Why is that? If the year begins on a favorable note AND indexes tend to move higher, bullish sentiment naturally has a tailwind at its back. Put another way, the bears are starting out at a disadvantage AND must overcome the market’s tendency to move higher.

Still, tools like the January Barometer are interesting signals, not guarantees. Market performance is still driven by economic fundamentals, as history has consistently demonstrated.

A strong start to a year can be derailed by policy missteps, recessions, rising interest rates, or other unexpected economic headwinds.

Elsewhere, the Federal Reserve surprised virtually no one on Wednesday by keeping its key rate, the fed funds rate, unchanged at 3.50 – 3.75%. Since the Fed began lowering rates at the September 2024 meeting, it has cut the fed funds rate by 1.75 percentage points.

Based on Fed Chief Jay Powell’s remarks, there was no indication that the Fed is considering a rate cut at its next meeting in March or in April, Powell’s final meeting before his term ends in May. Otherwise, the meeting offered few surprises. It was very much a steady‑as‑she‑goes affair.

On Friday, President Trump nominated former Fed Governor Kevin Warsh to be the next Federal Reserve chairman. He served as a Fed governor between 2006 and 2011. The decision was generally praised on Wall Street. He has, however, been a critic of the Fed in recent years.

While Powell has resisted the president’s call for much lower rates, Warsh has recently aligned himself with Trump. Historically, Warsh’s attention has been on inflation and sound money.

Remarks from a Fed chief can never be dismissed. He/she leads the world’s most powerful central bank. The Fed chair is influential but is one of 12 votes when setting policy.

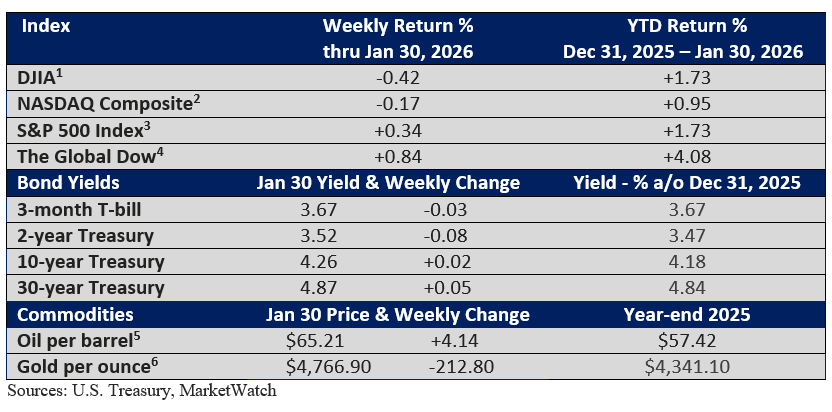

Market Summary

Two FOR THE ROAD

On April 8th, 2025, the S&P 500 was down over 15% on the year, its 4th-worst start to a year ever. But after a 38% rally, it was up 17% on the year, hitting 38 all-time highs along the way. This has been one of the greatest market comebacks in history. - CNBC, December 24, 2025

“Volatility is the price of admission. The prize inside is superior long-term returns.” - Charlie Munger

Please let me know if you have any questions or concerns that you would like to discuss.

I hope you have a wonderful week!

Warmest Regards,

Bill Stordahl, CFP®

Managing Director

Stordahl Capital Management

Stordahl Capital Management, Inc is a Registered Investment Adviser. This commentary is solely for informational purposes and reflects the personal opinions, viewpoints, and analyses of Stordahl Capital Management, Inc. and should not be regarded as a description of advisory services or performance returns of any SCM Clients. The views reflected in the commentary are subject to change at any time without notice. Nothing in this piece constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Advisory services are only offered to clients or prospective clients where Stordahl Capital Management and its representatives are properly licensed or exempt from licensure. No advice may be rendered by Stordahl Capital Management unless a client service agreement is in place. Stordahl Capital Management, Inc provides links for your convenience to websites produced by other providers or industry-related material. Accessing websites through links directs you away from our website. Stordahl Capital Management is not responsible for errors or omissions in the material on third-party websites and does not necessarily approve of or endorse the information provided. Users who gain access to third-party websites may be subject to the copyright and other restrictions on use imposed by those providers and assume responsibility and risk from the use of those websites. Please note that trading instructions through email, fax, or voicemail will not be taken. Your identity and timely retrieval of instructions cannot be guaranteed. Stordahl Capital Management, Inc. manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.

1. The Dow Jones Industrials Average is an unmanaged index of 30 major companies which cannot be invested into directly. Past performance does not guarantee future results.

2. The NASDAQ Composite is an unmanaged index of companies which cannot be invested into directly. Past performance does not guarantee future results.

3. The S&P 500 Index is an unmanaged index of 500 larger companies which cannot be invested into directly. Past performance does not guarantee future results.

4. The Global Dow is an unmanaged index composed of stocks of 150 top companies. It cannot be invested into directly. Past performance does not guarantee future results.

5. CME Group front-month contract; Prices can and do vary; past performance does not guarantee future results.

6. CME Group continuous contract; Prices can and do vary; past performance does not guarantee future results.