The Week in Review: December 15, 2025

Fed Cuts Rates Again, Signals a Possible Pause

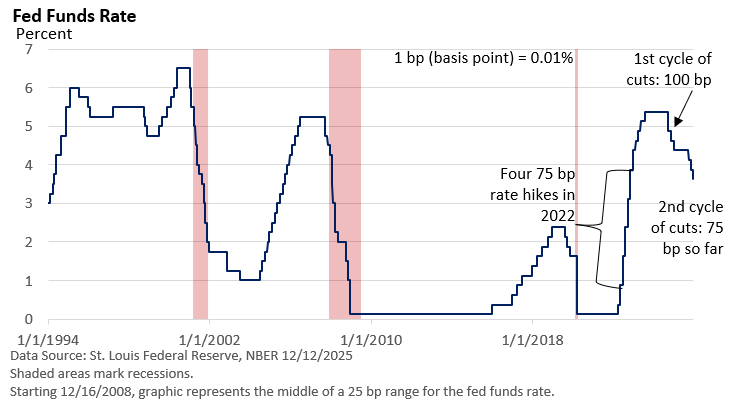

The Federal Reserve followed through on what was a widely expected rate cut, reducing the fed funds rate a quarter-percentage point (1 basis point = 0.01%) to a range of 3.50 – 3.75%.

This is the third rate cut—totaling 75 basis points—in as many meetings. Since the Fed first implemented a rate reduction following a steep series of rate cuts in 2023 and 2023, the Fed has cut its key lending rate by 175 basis points.

The rate cut was widely expected—no surprise. So, why did the Dow and the S&P 500 Index rally on Wednesday and set new record highs on Thursday (CNBC)?

Moreover, the rally occurred despite an apparent signal that the Fed may forgo another reduction in rates at the late January meeting.

Partly, it may just be how Fed Chief Powell carefully balanced his remarks after the Fed’s decision.

In some respects, it was a hawkish Fed rate cut: reduce the Fed funds rate but signal that the central bank is done for now.

Powell said the Fed is “well positioned” (six times) to “wait and see” (four times) regarding whether the economy needs lower rates next year.

The statement issued by the Fed, which announced the lower fed funds rate, included language that suggested no more rate cuts, at least at the next meeting. Plus, the Fed’s own projections signal just one rate cut next year. The Fed meets eight times every year.

Two of eleven Fed officials opposed a rate cut. Typically, decisions are unanimous.

But Powell smoothed away some of the rougher edges, too.

He said no one at the Fed believes the next move will be a rate hike.

He highlighted that job growth has been soft, and the economy may actually be shedding jobs, which would suggest the rate-cut option is open.

He deemphasized worries about inflation. He believes that inflation related to tariffs could peak sometime in the first quarter, assuming no new tariffs are implemented. Put another way, the mild uptick in the jobless rate seemed to take precedence over bringing inflation back down to the Fed’s 2% annual target.

One more thing that caught investors' attention: the Fed raised its economic outlook for 2026.

What conditions might prompt the Fed to pursue a more aggressive series of rate cuts?

A big slowdown in the rate of inflation.

Economic growth stalls.

A Fed that becomes much more receptive to the president’s desire for substantial rate cuts.

Market Summary

Two For The road

Just over half of Americans (54%) view capitalism positively, down six percentage points since 2021 and below the near-60% level recorded most years since 2010. Young adults, the most supportive of capitalism at the start of the trend in 2010, have been the least supportive age group since 2018. - Gallup, September 8, 2025

“There are two ways to enslave a country. One is by the sword. The other is by debt.” – John Adams

Please do not hesitate to contact me with any questions or concerns.

I hope you have a great week!

Warmest Regards,

Bill Stordahl, CFP®

Managing Director

Stordahl Capital Management

Stordahl Capital Management, Inc is a Registered Investment Adviser. This commentary is solely for informational purposes and reflects the personal opinions, viewpoints, and analyses of Stordahl Capital Management, Inc. and should not be regarded as a description of advisory services or performance returns of any SCM Clients. The views reflected in the commentary are subject to change at any time without notice. Nothing in this piece constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Advisory services are only offered to clients or prospective clients where Stordahl Capital Management and its representatives are properly licensed or exempt from licensure. No advice may be rendered by Stordahl Capital Management unless a client service agreement is in place. Stordahl Capital Management, Inc provides links for your convenience to websites produced by other providers or industry-related material. Accessing websites through links directs you away from our website. Stordahl Capital Management is not responsible for errors or omissions in the material on third-party websites and does not necessarily approve of or endorse the information provided. Users who gain access to third-party websites may be subject to the copyright and other restrictions on use imposed by those providers and assume responsibility and risk from the use of those websites. Please note that trading instructions through email, fax, or voicemail will not be taken. Your identity and timely retrieval of instructions cannot be guaranteed. Stordahl Capital Management, Inc. manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.

1. The Dow Jones Industrials Average is an unmanaged index of 30 major companies which cannot be invested into directly. Past performance does not guarantee future results.

2. The NASDAQ Composite is an unmanaged index of companies which cannot be invested into directly. Past performance does not guarantee future results.

3. The S&P 500 Index is an unmanaged index of 500 larger companies which cannot be invested into directly. Past performance does not guarantee future results.

4. The Global Dow is an unmanaged index composed of stocks of 150 top companies. It cannot be invested into directly. Past performance does not guarantee future results.

5. CME Group front-month contract; Prices can and do vary; past performance does not guarantee future results.

6. CME Group continuous contract; Prices can and do vary; past performance does not guarantee future results.