The Week in Review: October 30, 2023

Breakneck Speed

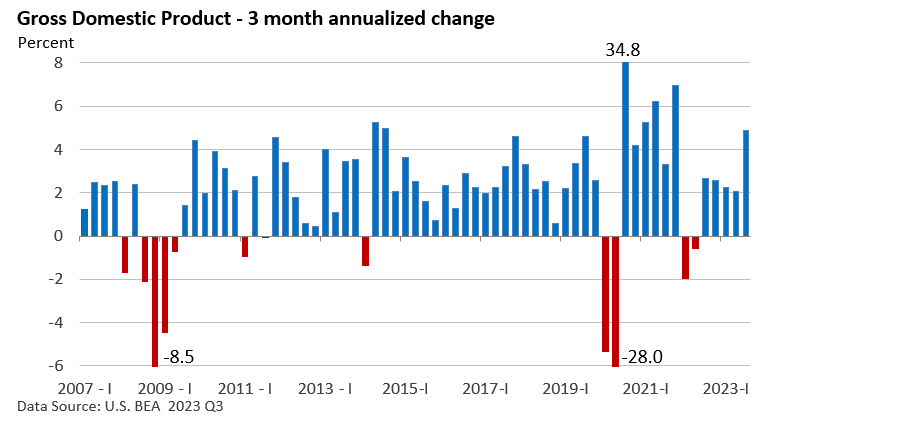

The U.S. Bureau of Economic Analysis (BEA) reported last week that Gross Domestic Product (GDP), which is the largest measure of goods and services for the economy, expanded at an annual pace of 4.9% in the third quarter.

It's the fastest growth rate since Q4 2021, when the economy was reopening, and consumers had plenty of stimulus cash in bank accounts.

When the quarter began, few saw a significant acceleration in economic growth.

According to the Atlanta Federal Reserve, the Blue Chip forecast of economic forecasters projected economic growth would nearly stall when the forecast was issued at the start of Q3.

The sharp rise in growth occurred mainly due to strong consumer spending, which makes up almost 70% of GDP (U.S. BEA).

Credit cards and cash still left in the bank from stimulus payments helped consumers go on a spending spree in Q3. But why Q3 and not the first half of the year? That’s not an easy question to answer.

Rising business inventories, along with increased government spending, including national defense contributed to economic growth.

Government spending contributes to the federal deficit. But in the short term, higher spending increases the demand for goods and services, which aids GDP.

GDP is a backward-looking indicator, as are most government reports. It’s backward-looking because it highlights what happened in the past. In this case, GDP reviews activity between July and September. We’re about to enter November.

What will the economy do for an encore in Q4? Economic forecasting is problematic.

There is no shortage of worries. Consumer confidence is shaky, as we pointed out last week, but people are spending, and companies have been hiring.

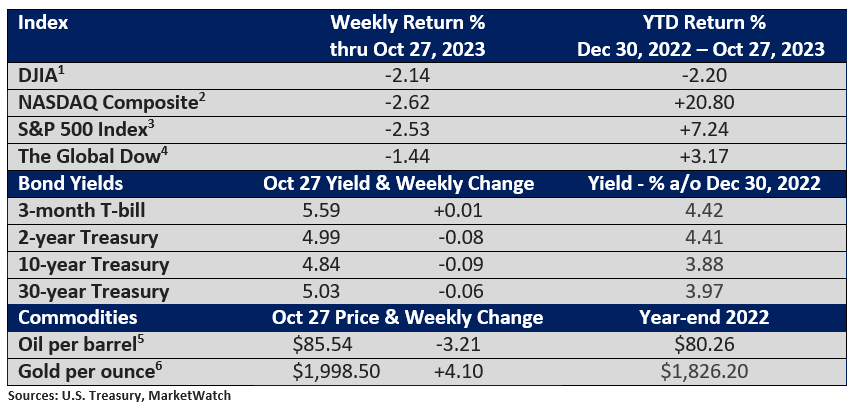

Market Summary

Two For the road

Americans 65 and up accounted for 22% of spending last year, the highest share since records began in 1972. - The Wall Street Journal, October 8, 2023

The World Bank estimates that in 2023, 691 million people (or 8.6% of the global population) will be living in extreme poverty, which would represent the lowest proportion in human history. -FutureCrunch, October 12, 2023

Please do not hesitate to contact me if you have any questions or concerns.

Stordahl Capital Management, Inc is a Registered Investment Adviser. This commentary is solely for informational purposes and reflects the personal opinions, viewpoints, and analyses of Stordahl Capital Management, Inc. and should not be regarded as a description of advisory services or performance returns of any SCM Clients. The views reflected in the commentary are subject to change at any time without notice. Nothing in this piece constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Advisory services are only offered to clients or prospective clients where Stordahl Capital Management and its representatives are properly licensed or exempt from licensure. No advice may be rendered by Stordahl Capital Management unless a client service agreement is in place. Stordahl Capital Management, Inc provides links for your convenience to websites produced by other providers or industry-related material. Accessing websites through links directs you away from our website. Stordahl Capital Management is not responsible for errors or omissions in the material on third-party websites and does not necessarily approve of or endorse the information provided. Users who gain access to third-party websites may be subject to the copyright and other restrictions on use imposed by those providers and assume responsibility and risk from the use of those websites. Please note that trading instructions through email, fax, or voicemail will not be taken. Your identity and timely retrieval of instructions cannot be guaranteed. Stordahl Capital Management, Inc. manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.

1. The Dow Jones Industrials Average is an unmanaged index of 30 major companies which cannot be invested into directly. Past performance does not guarantee future results.

2. The NASDAQ Composite is an unmanaged index of companies which cannot be invested into directly. Past performance does not guarantee future results.

3. The S&P 500 Index is an unmanaged index of 500 larger companies which cannot be invested into directly. Past performance does not guarantee future results.

4. The Global Dow is an unmanaged index composed of stocks of 150 top companies. It cannot be invested into directly. Past performance does not guarantee future results.

5. CME Group front-month contract; Prices can and do vary; past performance does not guarantee future results.

6. CME Group continuous contract; Prices can and do vary; past performance does not guarantee future results.