The Week in Review: November 20, 2023

Softer Inflation Raises Odds the Fed is Done

The U.S. Bureau of Labor Statistics (BLS) reported that the Consumer Price Index (CPI) was unchanged in October from the prior month. It is up 3.2% from a year ago.

Excluding volatile food and energy prices, the core CPI rose 0.2%. The core CPI is up 4% compared to one year ago, which represents the smallest increase since September 2021.

Economists focus on the core CPI, which might seem puzzling given that food and energy are items that everyone purchases. These categories, especially energy, can experience wild fluctuations, and economic policy has less of an impact on them.

As of June 2022, energy was up 41% from the prior year. As of October, it decreased by 4.5% (U.S. BLS). Historical data show the headline CPI tends to return to the core rate.

While inflation remains well above the Fed’s annual goal of 2%, recent news is encouraging. But before we jump in, let’s cover a couple of terms.

When economists talk about a slowdown in inflation, they are not referring to a decrease in prices. Rather, they are talking about a deceleration in the rate of inflation.

Since the annual rate of the core CPI peaked at 6.6% in September 2022, it has slowed to 4.0% as of October (U.S. BLS). The overall CPI peaked most recently at 9.1%.

Don’t expect the general price level to fall back to pre-pandemic levels. Deflation, defined as an actual decline in the price level, has been very rare in the U.S. in modern times.

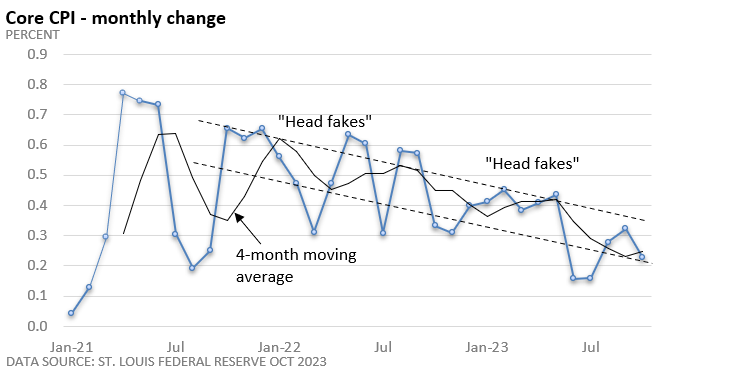

The graphic below highlights the change in the monthly rate. Progress has been uneven, but we’re seeing progress.

There have been head fakes over the last year but note that subsequent peaks have been trending lower. Fed Chief Powell even referenced “head fakes” in a recent speech.

Investors, however, have warmed to the slowdown in the rate of inflation. No one has a clear view of the future, but the improving trend raises the odds that the Fed is done hiking interest rates.

That’s an important reason why stocks have rallied this month.

Market Summary

Two For the road

In the first week of November, U.S. crude oil production hit 13.2 million barrels per day, a new record. - November 9, 2023

Just eight days account for all of the S&P 500’s 14% gain in 2023. The number of “up” days (113) for the index so far is just 11 more than the number of "down days" (102). - Morningstar, November 8, 2023

Please do not hesitate to contact me if you have any questions or concerns.

Stordahl Capital Management, Inc is a Registered Investment Adviser. This commentary is solely for informational purposes and reflects the personal opinions, viewpoints, and analyses of Stordahl Capital Management, Inc. and should not be regarded as a description of advisory services or performance returns of any SCM Clients. The views reflected in the commentary are subject to change at any time without notice. Nothing in this piece constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Advisory services are only offered to clients or prospective clients where Stordahl Capital Management and its representatives are properly licensed or exempt from licensure. No advice may be rendered by Stordahl Capital Management unless a client service agreement is in place. Stordahl Capital Management, Inc provides links for your convenience to websites produced by other providers or industry-related material. Accessing websites through links directs you away from our website. Stordahl Capital Management is not responsible for errors or omissions in the material on third-party websites and does not necessarily approve of or endorse the information provided. Users who gain access to third-party websites may be subject to the copyright and other restrictions on use imposed by those providers and assume responsibility and risk from the use of those websites. Please note that trading instructions through email, fax, or voicemail will not be taken. Your identity and timely retrieval of instructions cannot be guaranteed. Stordahl Capital Management, Inc. manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.

1. The Dow Jones Industrials Average is an unmanaged index of 30 major companies which cannot be invested into directly. Past performance does not guarantee future results.

2. The NASDAQ Composite is an unmanaged index of companies which cannot be invested into directly. Past performance does not guarantee future results.

3. The S&P 500 Index is an unmanaged index of 500 larger companies which cannot be invested into directly. Past performance does not guarantee future results.

4. The Global Dow is an unmanaged index composed of stocks of 150 top companies. It cannot be invested into directly. Past performance does not guarantee future results.

5. CME Group front-month contract; Prices can and do vary; past performance does not guarantee future results.

6. CME Group continuous contract; Prices can and do vary; past performance does not guarantee future results.