The Week in Review: November 18, 2024

Inflation—Not Back to Target, Not Enough to Derail a December Rate Cut

The Consumer Price Index (CPI) rose 0.2% in October, according to the U.S. Bureau of Labor Statistics. The core CPI, which excludes food and energy, rose 0.3% last month. The CPI is up 2.6% compared to one year ago, and the core CPI is up 3.3%.

After reviewing the details, let’s examine the trends. As previously mentioned, the annual core rate was 3.3% in October, the same as it was five months ago.

First, let’s address a disconnect regarding inflation. Investors and the Federal Reserve are more focused on the inflation rate and its dramatic slowdown since peaking in 2022.

Everyday shoppers are relieved prices aren’t rising at 2022’s pace, but their primary focus has been on the current price level, which is much higher than pre-pandemic levels.

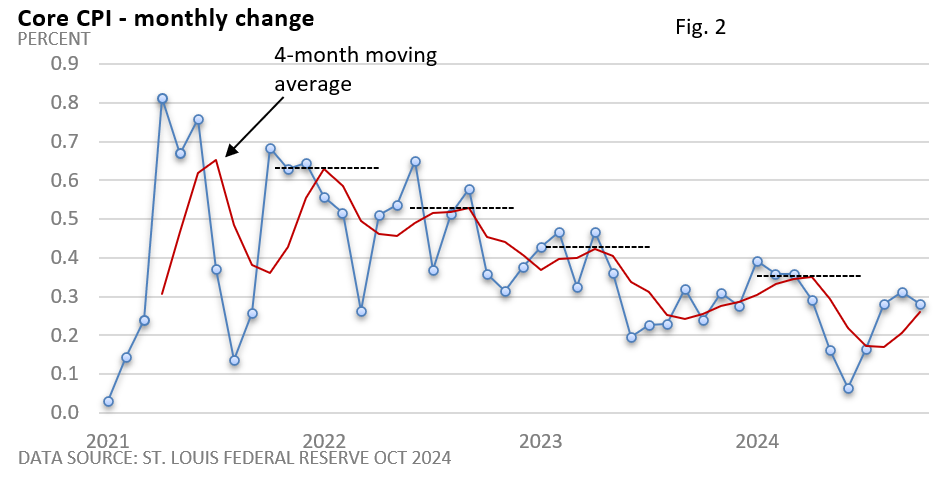

Figure 2 highlights the monthly change in the core CPI. The red line highlights the 4-month average, which helps smooth away the noise that can accompany the monthly numbers.

What do we see? The monthly figures for August—October 2024 are slightly higher than those from the same period in 2023, which might be concerning and worth monitoring. However, it’s important to note that the peaks and valleys in the 4-month average remain to the downside.

An interruption in that trend might be cause for alarm.

For now, it can be argued that the inflation rate remains in a gradual downward trend.

Today’s stickiness in inflation may be a catch-up of big price hikes in 2022 and 2023. For example, auto insurance soared, reflecting the earlier rise in car prices.

The data alone did not contain much that might discourage the Fed from reducing the Fed funds rate at its December meeting.

Yet, in a speech last Thursday in Dallas, Fed Chief Jay Powell said, “The economy is not sending any signals that we need to be in a hurry (my emphasis) to lower rates.”

He didn’t say, “The economy is not sending any signals that we need to… lower rates.” That would have slammed the door shut on a December rate cut.

However, he’s taking an aggressive path lower off the table amid upbeat economic growth.

Market Summary

Two for the Road

From January to September of 2024, there were 38.1 million televisions sold with a width of at least 97 inches, or just over 8 feet. The first 98-inch television from Samsung was introduced in 2019, priced at $99,000, and this year, it has four similar models starting at $4,000. - Numlock News, November 4, 2024

In 2005, the typical home seller in the U.S. was only 47 years old. Today, the typical home seller is 63, the oldest ever recorded. - MarketWatch, November 5, 2024

Please do not hesitate to contact me with any questions or concerns. I hope you have a wonderful week!

Bill Stordahl, CFP®

Managing Director

Stordahl Capital Management

Stordahl Capital Management, Inc is a Registered Investment Adviser. This commentary is solely for informational purposes and reflects the personal opinions, viewpoints, and analyses of Stordahl Capital Management, Inc. and should not be regarded as a description of advisory services or performance returns of any SCM Clients. The views reflected in the commentary are subject to change at any time without notice. Nothing in this piece constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Advisory services are only offered to clients or prospective clients where Stordahl Capital Management and its representatives are properly licensed or exempt from licensure. No advice may be rendered by Stordahl Capital Management unless a client service agreement is in place. Stordahl Capital Management, Inc provides links for your convenience to websites produced by other providers or industry-related material. Accessing websites through links directs you away from our website. Stordahl Capital Management is not responsible for errors or omissions in the material on third-party websites and does not necessarily approve of or endorse the information provided. Users who gain access to third-party websites may be subject to the copyright and other restrictions on use imposed by those providers and assume responsibility and risk from the use of those websites. Please note that trading instructions through email, fax, or voicemail will not be taken. Your identity and timely retrieval of instructions cannot be guaranteed. Stordahl Capital Management, Inc. manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.

1. The Dow Jones Industrials Average is an unmanaged index of 30 major companies which cannot be invested into directly. Past performance does not guarantee future results.

2. The NASDAQ Composite is an unmanaged index of companies which cannot be invested into directly. Past performance does not guarantee future results.

3. The S&P 500 Index is an unmanaged index of 500 larger companies which cannot be invested into directly. Past performance does not guarantee future results.

4. The Global Dow is an unmanaged index composed of stocks of 150 top companies. It cannot be invested into directly. Past performance does not guarantee future results.

5. CME Group front-month contract; Prices can and do vary; past performance does not guarantee future results.

6. CME Group continuous contract; Prices can and do vary; past performance does not guarantee future results.