Fed Leadership Transition: What Investors Should Know About Interest Rate Policy

The Federal Reserve serves a critical function for long-term investors by maintaining economic stability and a healthy financial system. In 2026, this role takes on added significance as Jerome Powell's tenure as Fed Chair concludes in May, presenting the administration with a chance to influence the central bank's future course. These developments may affect interest rate policy, equity markets, and investment portfolios.

Although financial media frequently emphasize immediate rate decisions, discussions among market participants and policymakers center on the appropriate scope of the Fed's responsibilities. The central bank's mission has evolved over its history, responding to financial disruptions and economic cycles. Among investors, perspectives vary regarding the extent of the Fed's powers and appropriate actions concerning interest rates and monetary supply.

As 2026 approaches, understanding these issues becomes increasingly important because they influence both immediate policy choices and the central bank's long-term trajectory. What should investors understand as Fed-related news dominates financial headlines?

Central bank responsibilities have grown throughout history

The Federal Reserve came into existence through the Federal Reserve Act of 1913, representing the nation's third effort to establish a central banking system. The Fed operates independently from the federal government and was not established through constitutional provisions. This structure creates three main points of discussion regarding Fed autonomy: 1) the institution's mandate has broadened considerably over the decades, 2) Fed policymakers are appointed rather than publicly elected, and 3) political leaders typically favor accommodative rate policies to encourage economic expansion and job creation.

Congress initially created the Fed with a focused objective: preventing banking panics. These financial disruptions plagued the 19th and early 20th centuries, creating hardship for businesses and citizens. Notable crises from this period include the Great Depression, along with the Panics of 1907 and 1893. These episodes typically intensified when depositors lost faith in their banks and attempted to withdraw funds simultaneously, threatening individual institutions and the broader financial infrastructure.

Although economic difficulties persist, such crises occur less frequently now. The Fed maintains bank capital requirements and functions as the "lender of last resort," providing a safety net during potential panic situations. The Fed's readiness to intervene helps maintain financial system stability and orderly market functioning. Recent examples include the 2020 pandemic response and the 2023 regional banking challenges.

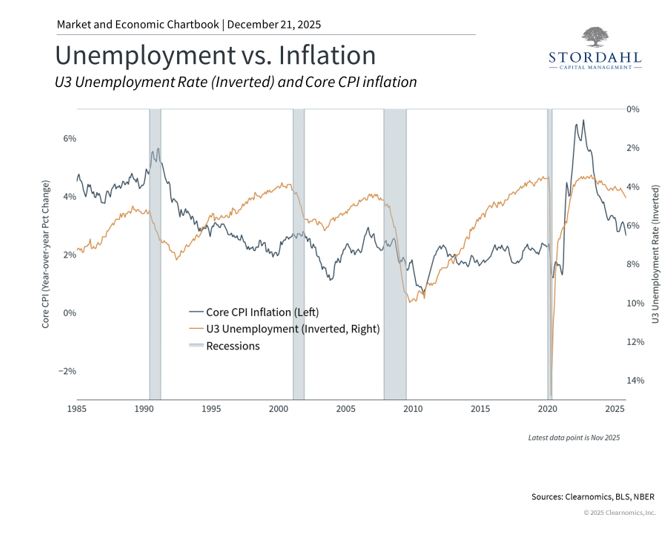

The central bank's mandate has expanded over time. The Federal Reserve Reform Act of 1977, passed amid elevated inflation and unemployment, charged the institution with promoting "maximum employment, stable prices, and moderate long-term interest rates." The Fed generally emphasizes the first two objectives as its "dual mandate," viewing the third as a natural outcome of achieving them.

This expansion is sometimes characterized as "mission creep," as the Fed now oversees not just banking operations, financial transactions, and currency exchange, but overall economic conditions. Regardless of one's perspective, this explains the intense focus on Federal Open Market Committee (FOMC) rate announcements, both for policy direction and insights into the Fed's economic outlook.

Central bank autonomy presents competing considerations

Fed policymakers receive presidential appointments and congressional confirmation, but lack direct electoral accountability. Some observers contend that this structure grants significant economic authority to unelected officials whose decisions impact all Americans. Others maintain that the Fed must sometimes implement politically unpopular measures, including policies that may temporarily constrain growth to ensure longer-term prosperity. Both perspectives have merit, making balanced assessment challenging.

The late 1970s and early 1980s illustrate this tradeoff effectively. During that period, economic disruptions and political pressure for accommodative monetary conditions produced "stagflation"—simultaneous high inflation and unemployment. Fed Chair Paul Volcker ultimately implemented aggressive rate increases, triggering a recession that ultimately resolved the stagflationary cycle. This experience established the precedent for central bank independence in subsequent decades.

Naturally, the Fed lacks perfect foresight and occasionally errs in its judgments. Former Fed Chair Ben Bernanke acknowledged to economist Milton Friedman that "you're right, we did it"—accepting responsibility for policy mistakes that exacerbated the Great Depression. More recently, many market observers believed the Fed responded too slowly to post-pandemic inflation emerging in 2021, necessitating abrupt rate increases.

Even with perfect information, the Fed's policy toolkit has limitations. The central bank primarily manages short-term rates through the federal funds rate. This is commonly described as a "blunt instrument" because adjusting one policy rate cannot address many fundamental economic challenges. Examples include the supply chain disruptions beginning in 2020 that elevated inflation, trade policy uncertainty, or workforce implications from artificial intelligence.

Furthermore, the Fed can only indirectly affect longer-term rates, which carry greater significance for home mortgages, business financing, and capital investment choices. Market forces including inflation expectations, government fiscal policy, and economic expansion determine these rates. Therefore, despite perceptions of Fed control over the economy and markets, the central bank more often influences conditions or responds to developments rather than directing them.

New leadership may influence policy approach in 2026 and beyond.

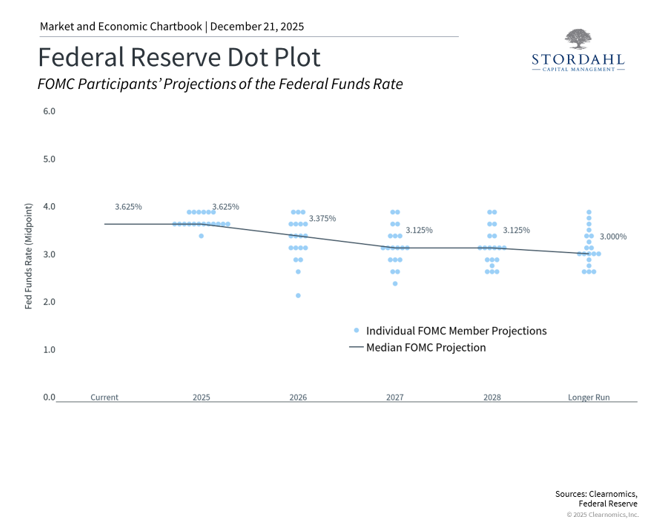

As Fed Chair Jerome Powell's term nears completion, the White House is anticipated to announce a successor in early 2026. Current leading candidates include Kevin Warsh, who previously served as a Fed governor, and Kevin Hassett, currently serving as Director of the National Economic Council. The situation remains fluid, with frontrunners having shifted in recent months.

The chart above displays the FOMC's most recent Summary of Economic Projections. These forecasts indicate the Fed may implement just one rate reduction in both 2026 and 2027. Whoever receives the nomination for Fed Chair, the administration will likely select someone favoring relatively accommodative policy rates. Consequently, these projections may evolve in coming months.

Nevertheless, investors should avoid overreacting to prospective policy shifts. Although the Fed Chair influences policy direction and serves as the FOMC's public spokesperson, the committee comprises twelve voting members representing varied perspectives. This includes the New York Fed President, seven Fed governors, and four regional bank presidents serving on a rotating basis. Historically, the Fed pursues consensus-building. Even a Chair sympathetic to administration priorities must persuade fellow committee members through economic analysis and policy reasoning.

Maintaining perspective proves valuable here, as Fed leadership transitions have occurred throughout history. The first chart demonstrates steady economic growth across different Fed Chairs appointed by administrations from both parties. It bears noting that President Trump nominated Jerome Powell during his first term, and Powell continued serving under President Biden.

What matters most is whether monetary policy appropriately addresses prevailing economic conditions, rather than any individual Chair's preferences. Once again, the Fed typically responds to external developments beyond its control, rather than directly managing the economy.

Broader economic conditions outweigh individual Fed actions.

Despite anticipated headlines regarding Fed leadership changes, the economy's overall trajectory remains most significant. The incoming Fed Chair may generally favor lower rates, but this will depend substantially on labor market conditions and inflation trends. For investors, maintaining a portfolio aligned with financial objectives matters more than reacting to daily Fed speculation.

The bottom line? Historical evidence demonstrates that markets have delivered strong performance across various Fed Chairs and policy frameworks. For investors, maintaining focus on long-term economic trends remains the most effective approach to reaching financial objectives.

Questions? We offer a complimentary 15-minute call to discuss your concerns and explore how we can assist you.

Stordahl Capital Management, Inc is a Registered Investment Adviser. This commentary is solely for informational purposes and reflects the personal opinions, viewpoints, and analyses of Stordahl Capital Management, Inc. and should not be regarded as a description of advisory services or performance returns of any SCM Clients. The views reflected in the commentary are subject to change at any time without notice. Nothing in this piece constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Advisory services are only offered to clients or prospective clients where Stordahl Capital Management and its representatives are properly licensed or exempt from licensure. No advice may be rendered by Stordahl Capital Management unless a client service agreement is in place. Stordahl Capital Management, Inc provides links for your convenience to websites produced by other providers or industry-related material. Accessing websites through links directs you away from our website. Stordahl Capital Management is not responsible for errors or omissions in the material on third-party websites and does not necessarily approve of or endorse the information provided. Users who gain access to third-party websites may be subject to the copyright and other restrictions on use imposed by those providers and assume responsibility and risk from the use of those websites. Please note that trading instructions through email, fax, or voicemail will not be taken. Your identity and timely retrieval of instructions cannot be guaranteed. Stordahl Capital Management, Inc. manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.

Copyright (c) 2024 Clearnomics, Inc. All rights reserved. The information contained herein has been obtained from sources believed to be reliable, but is not necessarily complete and its accuracy cannot be guaranteed. No representation or warranty, express or implied, is made as to the fairness, accuracy, completeness, or correctness of the information and opinions contained herein. The views and the other information provided are subject to change without notice. All reports posted on or via www.clearnomics.com or any affiliated websites, applications, or services are issued without regard to the specific investment objectives, financial situation, or particular needs of any specific recipient and are not to be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. Past performance is not necessarily a guide to future results. Company fundamentals and earnings may be mentioned occasionally, but should not be construed as a recommendation to buy, sell, or hold the company's stock. Predictions, forecasts, and estimates for any and all markets should not be construed as recommendations to buy, sell, or hold any security--including mutual funds, futures contracts, and exchange traded funds, or any similar instruments. The text, images, and other materials contained or displayed in this report are proprietary to Clearnomics, Inc. and constitute valuable intellectual property. All unauthorized reproduction or other use of material from Clearnomics, Inc. shall be deemed willful infringement(s) of this copyright and other proprietary and intellectual property rights, including but not limited to, rights of privacy. Clearnomics, Inc. expressly reserves all rights in connection with its intellectual property, including without limitation the right to block the transfer of its products and services and/or to track usage thereof, through electronic tracking technology, and all other lawful means, now known or hereafter devised. Clearnomics, Inc. reserves the right, without further notice, to pursue to the fullest extent allowed by the law any and all criminal and civil remedies for the violation of its rights.