Estate Planning: Important Considerations Amid Political Uncertainty

After a lifetime of working hard, saving diligently, and investing wisely, one of the key considerations is how to pass these assets to future generations.

This is where estate planning comes in. While many investors rightly start by focusing on portfolio allocation and retirement savings, they often delay addressing how their assets will be distributed after death. This has become increasingly costly as estate tax laws have undergone significant changes, with Congress recently passing legislation that could extend current estate tax provisions.

Estate planning is one of the most overlooked yet critical components of comprehensive financial planning. This is relevant for all families, whether they manage substantial portfolios or simply need to leave assets to loved ones in the best possible way.

Understanding these evolving regulations and using appropriate strategies can mean the difference between preserving wealth for future generations and gifting to charitable causes, or losing significant portions to taxation.

Estate planning can be a complex topic that extends beyond simply writing a will. In this article, we’ll provide an overview of important considerations, including tax optimization, asset protection, and ensuring that your financial legacy aligns with your values and intentions. For investors, this represents both challenges and opportunities to structure their affairs in ways that maximize what they can pass to their beneficiaries.

Federal estate tax exemptions remain at historic highs.

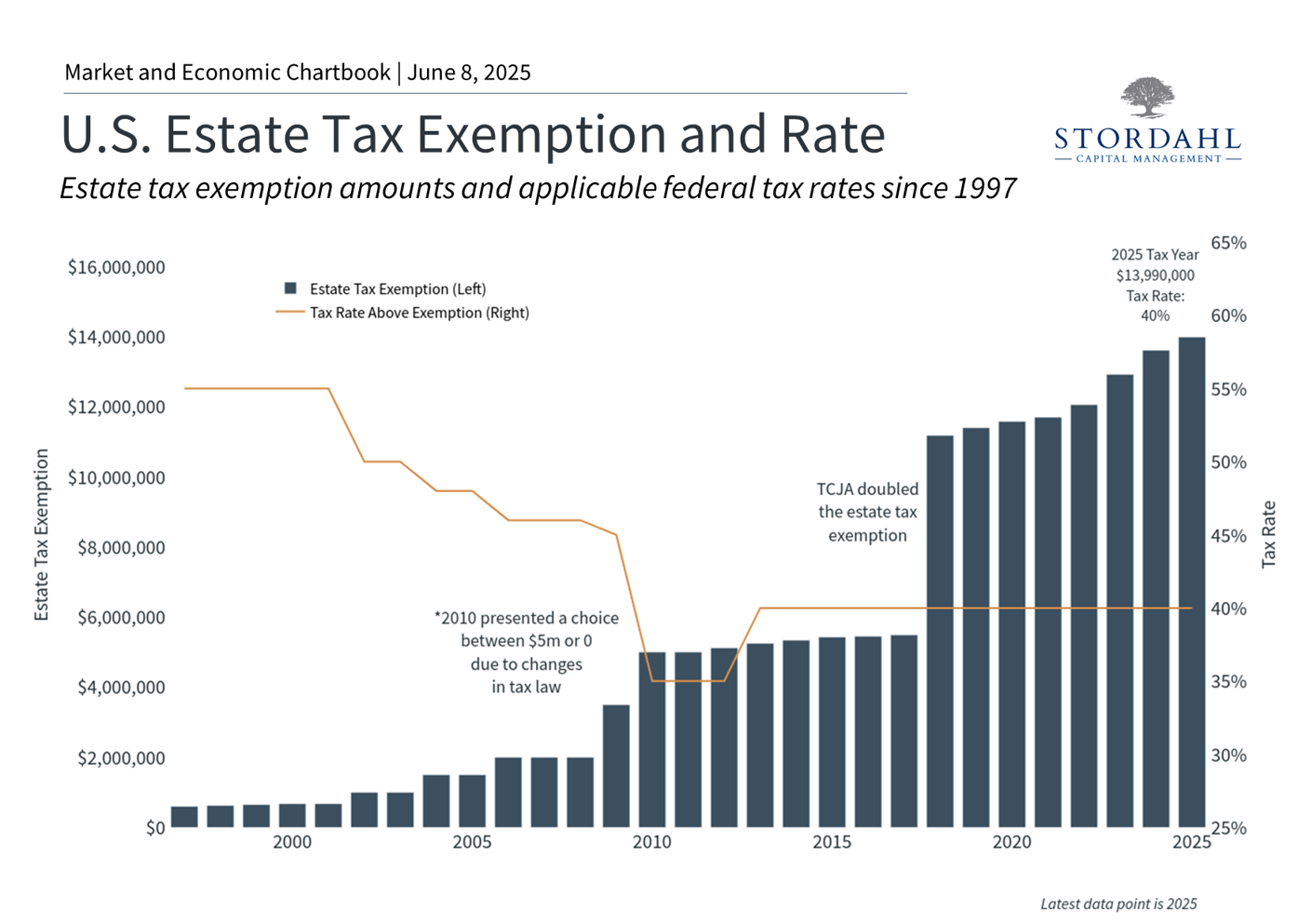

Currently, individuals can pass up to $13.99 million to their heirs without triggering federal estate taxes, while married couples can transfer up to $27.98 million. These exemption levels, established under the Tax Cuts and Jobs Act of 2017 and adjusted each year for inflation, represent some of the highest thresholds in U.S. history.

Without Congressional action, these provisions would be set to expire at the end of 2025, at which point the exemptions would revert to their 2017 levels of approximately $5.49 million per individual, adjusted for inflation.

However, the current budget, which the House of Representatives has approved, would not only extend these provisions permanently but also expand them to $15 million for individuals and $30 million for married couples in 2026. These numbers could change as the bill is debated in the Senate.

The accompanying chart shows how estate tax exemptions and rates have evolved over time. What's noteworthy is that while exemption levels have increased dramatically, the top tax rate of 40% has remained relatively stable in recent years. This creates a significant planning opportunity for families whose estates exceed the potential future thresholds.

Gifting strategies can help reduce taxable estates.

For families with substantial wealth, annual gifting represents one of the most straightforward strategies to reduce future estate tax liabilities.

The annual gift tax exclusion for 2025 allows individuals to give up to $19,000 per recipient without using any of their lifetime exemption. This means a married couple with five grandchildren could collectively gift $190,000 annually without tax consequences, effectively reducing their taxable estate each year.

The power of consistent gifting is most apparent when viewed over time. A family that maximizes annual exclusions over a decade or more can transfer millions of dollars while avoiding both gift and estate taxes. This strategy is even more valuable when combined with assets that are expected to appreciate, since future growth would occur outside the taxable estate.

Beyond annual exclusions, the current lifetime gift tax exemption of $13.99 million provides additional planning opportunities. Some families are choosing to make large gifts now to lock in the current exemption levels just in case the law changes in the future. Of course, this approach requires careful consideration of future financial needs and the family's overall objectives.

State tax considerations add complexity.

While the federal estate tax affects only the wealthiest families, state-level taxes can impact a broader range of estates. This means that residency decisions can have significant tax implications. For example, Florida and Texas do not apply estate taxes at the state level, while New York and Massachusetts have stricter exemption thresholds than the federal level.

State tax laws also change frequently, adding another layer of uncertainty to long-term planning. What may be a tax-efficient strategy today could become less attractive if state legislatures modify their approach to estate taxation. This underscores the importance of regular plan reviews and maintaining flexibility in estate planning structures.

Trusts and other planning tools provide flexibility.

Beyond basic wills, estate planning often involves trusts and other advanced techniques. For instance, irrevocable life insurance trusts can remove life insurance proceeds from taxable estates. Charitable remainder trusts can provide income to beneficiaries while generating tax deductions and supporting philanthropic goals.

Additionally, the stepped-up basis provision remains a significant benefit for inherited assets. This rule adjusts an inherited asset's cost basis to its fair market value at the time of the owner's death, potentially eliminating capital gains taxes on appreciation that occurred during the original owner's lifetime. While this provision has faced political challenges, it currently remains in effect and represents an important consideration in estate planning strategies.

The uncertain economic and political environment underscores the importance of estate planning decisions. With asset values at elevated levels, interest rates providing attractive returns on cash, and historically attractive tax provisions, families have more options for structuring their wealth transfer strategies.

The bottom line? Estate planning is more important than ever, but has also become increasingly complex. All families should review their estate planning regularly as part of their comprehensive financial plans.

If you want to discuss this further, we offer a complimentary 15-minute call to discuss your concerns and share how we can help.

Stordahl Capital Management, Inc is a Registered Investment Adviser. This commentary is solely for informational purposes and reflects the personal opinions, viewpoints, and analyses of Stordahl Capital Management, Inc. and should not be regarded as a description of advisory services or performance returns of any SCM Clients. The views reflected in the commentary are subject to change at any time without notice. Nothing in this piece constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Advisory services are only offered to clients or prospective clients where Stordahl Capital Management and its representatives are properly licensed or exempt from licensure. No advice may be rendered by Stordahl Capital Management unless a client service agreement is in place. Stordahl Capital Management, Inc provides links for your convenience to websites produced by other providers or industry-related material. Accessing websites through links directs you away from our website. Stordahl Capital Management is not responsible for errors or omissions in the material on third-party websites and does not necessarily approve of or endorse the information provided. Users who gain access to third-party websites may be subject to the copyright and other restrictions on use imposed by those providers and assume responsibility and risk from the use of those websites. Please note that trading instructions through email, fax, or voicemail will not be taken. Your identity and timely retrieval of instructions cannot be guaranteed. Stordahl Capital Management, Inc. manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.

Copyright (c) 2024 Clearnomics, Inc. All rights reserved. The information contained herein has been obtained from sources believed to be reliable, but is not necessarily complete and its accuracy cannot be guaranteed. No representation or warranty, express or implied, is made as to the fairness, accuracy, completeness, or correctness of the information and opinions contained herein. The views and the other information provided are subject to change without notice. All reports posted on or via www.clearnomics.com or any affiliated websites, applications, or services are issued without regard to the specific investment objectives, financial situation, or particular needs of any specific recipient and are not to be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. Past performance is not necessarily a guide to future results. Company fundamentals and earnings may be mentioned occasionally, but should not be construed as a recommendation to buy, sell, or hold the company's stock. Predictions, forecasts, and estimates for any and all markets should not be construed as recommendations to buy, sell, or hold any security--including mutual funds, futures contracts, and exchange traded funds, or any similar instruments. The text, images, and other materials contained or displayed in this report are proprietary to Clearnomics, Inc. and constitute valuable intellectual property. All unauthorized reproduction or other use of material from Clearnomics, Inc. shall be deemed willful infringement(s) of this copyright and other proprietary and intellectual property rights, including but not limited to, rights of privacy. Clearnomics, Inc. expressly reserves all rights in connection with its intellectual property, including without limitation the right to block the transfer of its products and services and/or to track usage thereof, through electronic tracking technology, and all other lawful means, now known or hereafter devised. Clearnomics, Inc. reserves the right, without further notice, to pursue to the fullest extent allowed by the law any and all criminal and civil remedies for the violation of its rights.