3 Tax Planning Opportunities Before December 31

As 2025 draws to a close, investors face important decisions that could impact their tax situations and long-term financial plans. While financial planning is a year-round activity, many calendar deadlines for tax-related activities fall on December 31. For this reason, the final weeks of the year offer investors a chance to review their tax strategies and finalize any items that may impact their 2025 taxes.

In this discussion, we highlight three strategies for investors to be aware of, including managing retirement account distributions, Roth conversions, and positioning portfolios for tax efficiency. These topics can be complex and there are many rules that affect different individuals in unique ways, so it’s always important to seek professional advice.

Required Minimum Distributions must be finalized before December 31.

Although investors spend most of their lives focused on growing their savings and portfolios, how they take distributions from their nest eggs is just as important. This is especially relevant for investors who have reached the age when Required Minimum Distributions (RMDs) begin. In these situations, December 31 is one of the most important calendar deadlines since missing it can result in significant IRS penalties, which today is 25% of the amount not withdrawn.

RMDs are the minimum amounts that must be withdrawn from traditional IRAs, 401(k)s, and other tax-deferred retirement accounts each year after individuals reach a certain age. The SECURE 2.0 Act, passed by Congress in 2022, raised the RMD age to 73 for those who turned 72 after December 31, 2022. This age will increase further to 75 in 2033.

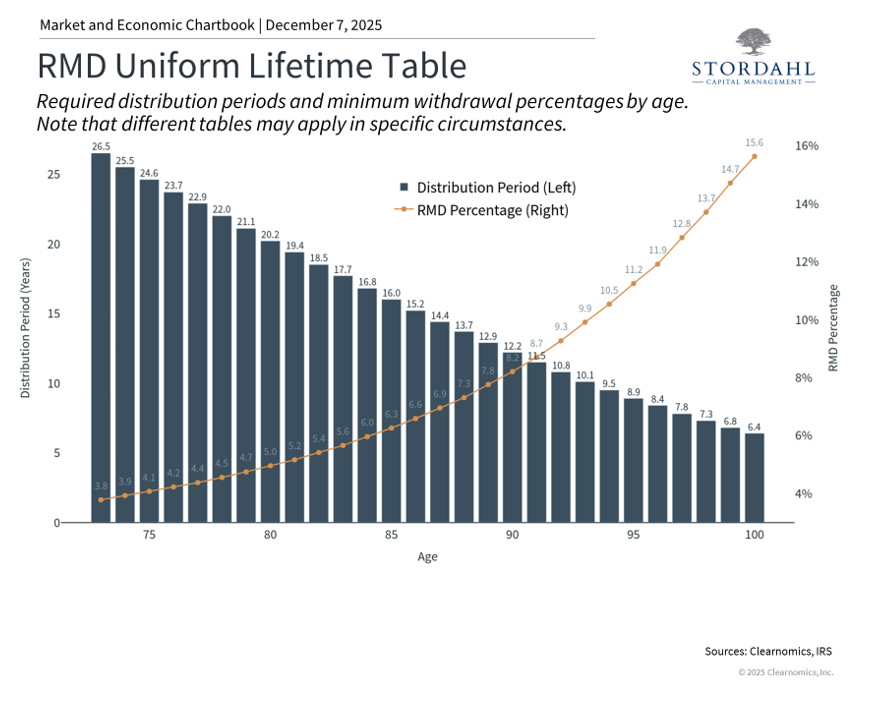

The chart above shows the latest distribution periods, in years, and the required withdrawal percentages that apply to most account owners. The withdrawal amount is based on the account balance as of December 31 of the prior year, adjusted by a life expectancy factor published by the IRS. While these numbers are based on relatively straightforward calculations, the planning considerations can be much more complex:

Account selection: Careful coordination is needed to decide which accounts to draw from first, when to make withdrawals throughout the year, and how to coordinate RMDs with other income sources. The order in which investors withdraw from different accounts can affect their overall tax bill, since Social Security benefits become taxable at certain thresholds and can trigger higher taxes.

First-year delay: There is an exception for those in their first year of RMDs which allows distributions to be delayed until April 1 of the following year. However, this may then require the investor to take two RMDs in the second year, which could push them into a higher tax bracket.

Other distribution strategies: There are other strategies such as Qualified Charitable Distributions (QCDs) which allow investors to donate to qualified charities directly from their IRA. This fulfills the RMD requirement without adding to taxable income. However, there are timing considerations around these decisions that require careful planning.

An important decision in the years leading up to age 73 is whether to take distributions even before RMDs begin. Some investors may benefit from withdrawing enough to “fill a tax bracket” (when the investor can increase their income before entering the next tax bracket). This can be valuable if they expect to be in a higher tax bracket once RMDs begin.

These factors highlight why retirement planning requires a multi-year perspective rather than focusing solely on a single tax year.

Roth conversions offer strategic opportunities in today's environment.

Roth conversions are another powerful year-end planning tool with a December 31 deadline.

Like RMDs, they require careful analysis and planning. A Roth conversion involves transferring assets from a traditional IRA to a Roth IRA, creating a taxable event now in exchange for tax-free growth and distributions later.

Unlike Roth contributions, which have income limits, conversions are available to all investors regardless of income level. For investors who don’t qualify for Roth IRAs due to these income limits, these are often known as “backdoor” Roth conversions.

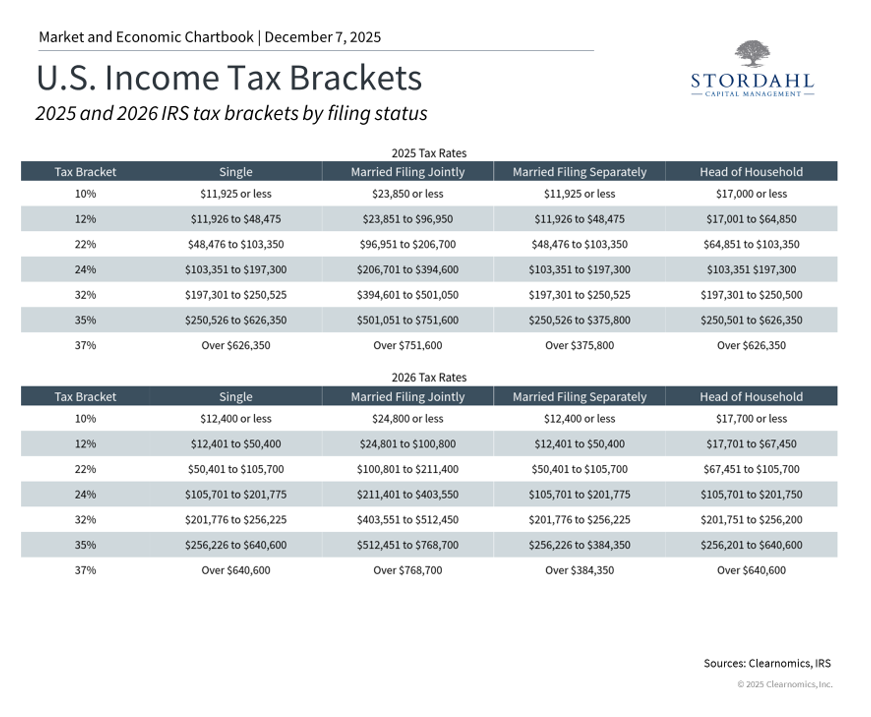

The "One Big Beautiful Bill" passed by Congress earlier this year makes the lower tax rates from the Tax Cuts and Jobs Act permanent. For many investors, current tax rates may be more favorable compared to what they might face in the future. With the ever-growing national debt and fiscal deficit, some investors may also worry that tax rates may rise in the future.

Key considerations to guide Roth conversion decisions include:

Tax bracket comparison: Investors should compare their current tax bracket to the one they expect to be in during retirement. If a higher tax bracket is anticipated in the future, perhaps due to RMDs, pension income, or Social Security benefits, paying taxes now on Roth conversions at a lower rate can be beneficial.

Time horizon for tax-free growth: The longer money can grow tax-free in the Roth account, the more valuable the conversion becomes. So, earlier is often better.

Medicare premiums: Higher income from Roth conversions can trigger Income-Related Monthly Adjustment Amounts (IRMAA), increasing Medicare Part B and Part D premiums. This doesn't necessarily mean conversions should be avoided, but it's another factor to consider in the overall analysis.

Tax-loss harvesting can help offset gains and reduce tax liability.

While RMDs and Roth conversions focus on retirement accounts, tax-loss harvesting is a strategy for taxable investment accounts that can help optimize current-year tax bills. This involves selling investments that have declined in value to realize capital losses, which can then offset capital gains realized earlier in the year. This activity also needs to take place before December 31 for the current tax year, and is thus an important part of any ongoing investment and financial plan.

How does this work in practice? If an investor sold investments during 2025 and realized capital gains, they can harvest losses from other positions to offset those gains dollar-for-dollar. Tax loss harvesting is valuable even in years when investors haven't realized significant gains. If an investor’s losses exceed their gains, they can use up to $3,000 of net capital losses to offset ordinary income annually, with any excess losses carried forward to future years.

Several factors affect the value of tax-loss harvesting:

Capital gains rates: Long-term capital gains (from investments held more than one year) are taxed at preferential rates of 0%, 15%, or 20% depending on income, while short-term gains are taxed at ordinary income rates. Harvesting losses to offset short-term gains can be particularly valuable since those gains would otherwise be taxed at higher rates. This may be even more valuable for those in high-tax states.

Wash sale rule: One important consideration here is known as the “wash sale” rule, which prohibits repurchasing the same or a "substantially identical" security within 30 days before or after the sale. This prevents investors from claiming a tax loss while maintaining the exact same investment position. Investors can, however, replace positions with similar investments such as an ETF, allowing them to maintain market exposure and their desired asset allocation while still harvesting the tax loss.

Account considerations: It's important to note that tax-loss harvesting only applies to taxable brokerage accounts, not to IRAs or 401(k)s where gains and losses are not taxable events. This is because retirement accounts grow tax-deferred regardless of trading activity within the account.

Coordinating these strategies requires careful planning.

The power of year-end financial planning comes not just from implementing individual strategies, but also from coordinating them effectively to maximize total benefits. Of course, it’s important to keep the big picture in mind. While reducing this year's tax bill is valuable, it shouldn't come at the expense of your broader financial goals. The best planning considers both immediate tax impacts and long-term wealth accumulation, ensuring that today's decisions support tomorrow's objectives.

The bottom line? There are timely actions that many investors can take before the end of the year. Now is the perfect time to review your tax and financial situation.

Questions? We offer a complimentary 15-minute call to discuss your concerns and explore how we can assist you.

Stordahl Capital Management, Inc is a Registered Investment Adviser. This commentary is solely for informational purposes and reflects the personal opinions, viewpoints, and analyses of Stordahl Capital Management, Inc. and should not be regarded as a description of advisory services or performance returns of any SCM Clients. The views reflected in the commentary are subject to change at any time without notice. Nothing in this piece constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Advisory services are only offered to clients or prospective clients where Stordahl Capital Management and its representatives are properly licensed or exempt from licensure. No advice may be rendered by Stordahl Capital Management unless a client service agreement is in place. Stordahl Capital Management, Inc provides links for your convenience to websites produced by other providers or industry-related material. Accessing websites through links directs you away from our website. Stordahl Capital Management is not responsible for errors or omissions in the material on third-party websites and does not necessarily approve of or endorse the information provided. Users who gain access to third-party websites may be subject to the copyright and other restrictions on use imposed by those providers and assume responsibility and risk from the use of those websites. Please note that trading instructions through email, fax, or voicemail will not be taken. Your identity and timely retrieval of instructions cannot be guaranteed. Stordahl Capital Management, Inc. manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.

Copyright (c) 2024 Clearnomics, Inc. All rights reserved. The information contained herein has been obtained from sources believed to be reliable, but is not necessarily complete and its accuracy cannot be guaranteed. No representation or warranty, express or implied, is made as to the fairness, accuracy, completeness, or correctness of the information and opinions contained herein. The views and the other information provided are subject to change without notice. All reports posted on or via www.clearnomics.com or any affiliated websites, applications, or services are issued without regard to the specific investment objectives, financial situation, or particular needs of any specific recipient and are not to be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. Past performance is not necessarily a guide to future results. Company fundamentals and earnings may be mentioned occasionally, but should not be construed as a recommendation to buy, sell, or hold the company's stock. Predictions, forecasts, and estimates for any and all markets should not be construed as recommendations to buy, sell, or hold any security--including mutual funds, futures contracts, and exchange traded funds, or any similar instruments. The text, images, and other materials contained or displayed in this report are proprietary to Clearnomics, Inc. and constitute valuable intellectual property. All unauthorized reproduction or other use of material from Clearnomics, Inc. shall be deemed willful infringement(s) of this copyright and other proprietary and intellectual property rights, including but not limited to, rights of privacy. Clearnomics, Inc. expressly reserves all rights in connection with its intellectual property, including without limitation the right to block the transfer of its products and services and/or to track usage thereof, through electronic tracking technology, and all other lawful means, now known or hereafter devised. Clearnomics, Inc. reserves the right, without further notice, to pursue to the fullest extent allowed by the law any and all criminal and civil remedies for the violation of its rights.