The Week in Review: June 20, 2023

The Fed Presses the Pause Button

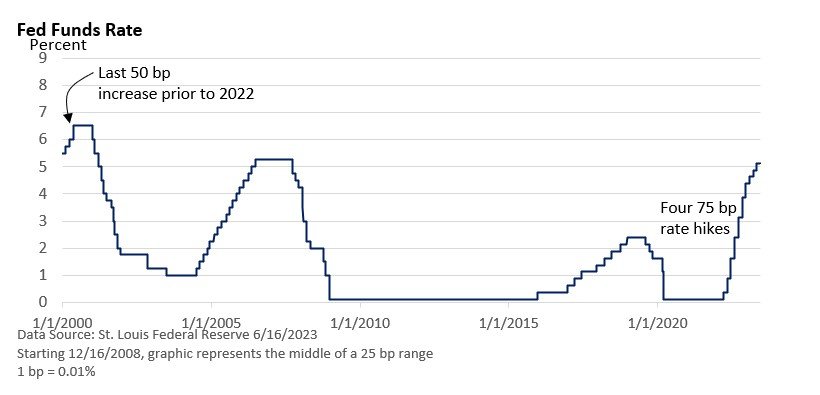

The Federal Reserve held the fed funds rate at 5.00–5.25% following ten consecutive rate increases that began in March 2022. The move was anticipated as policymakers had previously expressed their intention, allowing them time to assess the impact of previous rate hikes.

However, several more weeks of data may not provide that much clarity, and the pause seems inconsistent with recent messaging on inflation. Given still-high inflation, the Fed’s forecast signals it is mulling two more 25 basis point (bp, 1 bp = 0.01%) rate hikes by year-end.

Most analysts viewed the Fed meeting as a “hawkish pause.” Why? Investors expected the Fed would skip in June and hike one more time in July.

Two more projected rate hikes this year seemed to come as a surprise at Wednesday’s meeting. The phrasing is relative since it’s much less aggressive than last year’s torrid pace.

Yet, Thursday’s rally suggests investors are skeptical about two more increases this year.

But it’s important to acknowledge that investors have been too optimistic on rates before. Much will depend on the economy and inflation, which has defied predictions of a sharper slowdown.

That said, this isn’t the Volcker Fed of the early 1980s when then-Fed Chief Paul Volcker pushed rates into the stratosphere, causing a steep recession that broke the back of inflation.

The Fed's current approach to restoring price stability differs from the early 1980s. Back then, the focus was getting double-digit inflation under control via a recession. Now, the Fed is taking a more balanced approach, as it hopes to achieve its goal of stable prices.

This marks a shift from last year, which was solely inflation. For now, a kinder, gentler Fed, an expanding economy, and the artificial intelligence craze have fueled the recent rally in stocks.

The 5 trillion dollar question

Part of the problem lies in the difficulty of forecasting metrics such as unemployment and inflation. The other part of the problem is modeling a shutdown and reopening the economy.

During the pandemic, the economy received an unprecedented injection of $5 trillion in stimulus. This, combined with closures and reopenings, has disrupted conventional forecasting models. It’s a new challenge for the Fed and economists.

Market Summary

Two for the Road

Eight companies (Alphabet, Amazon, Apple, Meta, Microsoft, Tesla, Netflix, and Nvidia) now make up 30% of the S&P 500’s market capitalization, up from 22% at the start of the year. - The Wall Street Journal, June 6, 2023

Last year, Americans spent $95 billion betting on sports in legal jurisdictions. That is more money than the amount spent on ride-sharing, coffee, or streaming. - MorningBrew, May 14, 2023

Stordahl Capital Management, Inc is a Registered Investment Adviser. This commentary is solely for informational purposes and reflects the personal opinions, viewpoints, and analyses of Stordahl Capital Management, Inc. and should not be regarded as a description of advisory services or performance returns of any SCM Clients. The views reflected in the commentary are subject to change at any time without notice. Nothing in this piece constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Advisory services are only offered to clients or prospective clients where Stordahl Capital Management and its representatives are properly licensed or exempt from licensure. No advice may be rendered by Stordahl Capital Management unless a client service agreement is in place. Stordahl Capital Management, Inc provides links for your convenience to websites produced by other providers or industry-related material. Accessing websites through links directs you away from our website. Stordahl Capital Management is not responsible for errors or omissions in the material on third-party websites and does not necessarily approve of or endorse the information provided. Users who gain access to third-party websites may be subject to the copyright and other restrictions on use imposed by those providers and assume responsibility and risk from the use of those websites. Please note that trading instructions through email, fax, or voicemail will not be taken. Your identity and timely retrieval of instructions cannot be guaranteed. Stordahl Capital Management, Inc. manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.

1. The Dow Jones Industrials Average is an unmanaged index of 30 major companies which cannot be invested into directly. Past performance does not guarantee future results.

2. The NASDAQ Composite is an unmanaged index of companies which cannot be invested into directly. Past performance does not guarantee future results.

3. The S&P 500 Index is an unmanaged index of 500 larger companies which cannot be invested into directly. Past performance does not guarantee future results.

4. The Global Dow is an unmanaged index composed of stocks of 150 top companies. It cannot be invested into directly. Past performance does not guarantee future results.

5. CME Group front-month contract; Prices can and do vary; past performance does not guarantee future results.

6. CME Group continuous contract; Prices can and do vary; past performance does not guarantee future results.