The Week in Review: July 17, 2023

Red-Hot Inflation Cools

Inflation has bedeviled consumers and investors for over a year. The Federal Reserve waited far too long in responding to high prices, and its abrupt reversal in 2022 pushed equities into a bear market.

But the Fed’s kinder, gentler approach this year and a resilient economy have helped shares rally off last year’s low. While lower oil prices have pushed headline inflation down sharply, prices outside of energy have been stickier on the upside… until recently.

The U.S. Bureau of Labor Statistics (BLS) reported that the Consumer Price Index (CPI) rose 0.2% in June. The core CPI, which excludes food and energy, also rose 0.2%, the slowest pace since February 2021.

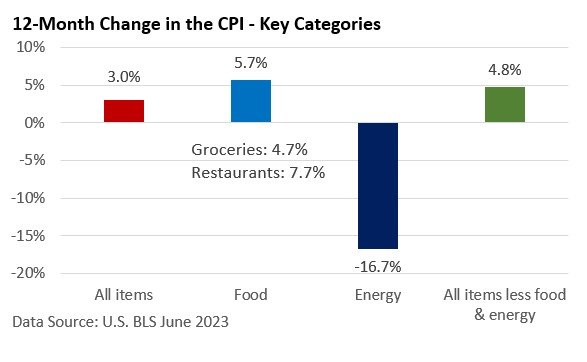

In June, the CPI rose 3.0% compared to a year ago, which is below the 4.0% rise in May. The core CPI decreased from 5.3% in May to 4.8% in June. While both readings are still above the Fed's 2.0% target, which it defines as price stability, the trend is cautiously encouraging.

The following image provides a broad overview of the current situation.

Energy has led the way lower, helping bring down the headline CPI to 3.0% from its year-ago peak of 9.1%. But everyday items have been slower to respond.

For example, the core CPI has been gradually improving but remains at a still-elevated 4.8%. It reached its highest point of 6.6% nine months ago.

Food at home (groceries) is higher, but its rate has slowed sharply since the beginning of the year. Prices at restaurants, however, continue to gallop ahead.

Progress on headline inflation may grind to a halt, at least in the short term, as energy prices peaked a year ago and fell in July 2022 (that makes the year-over-year comparison more difficult).

Core inflation is tougher to get a handle on since the basket of goods and services measured has so many moving parts. But the general trend is cautiously encouraging. Investors see a slowdown in inflation as beneficial because it eases pressure on interest rates, which in turn supports stocks.

The Fed is not ready to declare ‘Mission Accomplished’ on inflation, and it has hinted at a rate hike at its July meeting. While we can’t predict their decisions with certainty, continued progress raises the prospect that the Fed is nearing an end to its rate-hike campaign.

Market Summary

Please do not hesitate to contact me if you have any questions or concerns.

Two for the Road

The median price for a home in Miami is $585,000. To afford that, homeowners would need to spend 79.9% of Miami’s average monthly income on homeownership expenses topping the amount paid by homeowners in Los Angeles and New York City. - Pressreader, June 20, 2023

China’s controversial one-child policy, in place for more than three decades, was removed in 2015. Most people would have guessed that the country’s birth rate would rise, however, the opposite happened. Birth rates in 2022 are now 6.77 babies born per 1,000 people- the lowest level on record. -Chartr, June 19, 2023

Stordahl Capital Management, Inc is a Registered Investment Adviser. This commentary is solely for informational purposes and reflects the personal opinions, viewpoints, and analyses of Stordahl Capital Management, Inc. and should not be regarded as a description of advisory services or performance returns of any SCM Clients. The views reflected in the commentary are subject to change at any time without notice. Nothing in this piece constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Advisory services are only offered to clients or prospective clients where Stordahl Capital Management and its representatives are properly licensed or exempt from licensure. No advice may be rendered by Stordahl Capital Management unless a client service agreement is in place. Stordahl Capital Management, Inc provides links for your convenience to websites produced by other providers or industry-related material. Accessing websites through links directs you away from our website. Stordahl Capital Management is not responsible for errors or omissions in the material on third-party websites and does not necessarily approve of or endorse the information provided. Users who gain access to third-party websites may be subject to the copyright and other restrictions on use imposed by those providers and assume responsibility and risk from the use of those websites. Please note that trading instructions through email, fax, or voicemail will not be taken. Your identity and timely retrieval of instructions cannot be guaranteed. Stordahl Capital Management, Inc. manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.

1. The Dow Jones Industrials Average is an unmanaged index of 30 major companies which cannot be invested into directly. Past performance does not guarantee future results.

2. The NASDAQ Composite is an unmanaged index of companies which cannot be invested into directly. Past performance does not guarantee future results.

3. The S&P 500 Index is an unmanaged index of 500 larger companies which cannot be invested into directly. Past performance does not guarantee future results.

4. The Global Dow is an unmanaged index composed of stocks of 150 top companies. It cannot be invested into directly. Past performance does not guarantee future results.

5. CME Group front-month contract; Prices can and do vary; past performance does not guarantee future results.

6. CME Group continuous contract; Prices can and do vary; past performance does not guarantee future results.